A few days ago, I published an article on Seeking Alpha titled, “Tesla: Robotaxis Are Not Its Future.” In this article, I expressed my bearish stance on Tesla (TSLA) and rated it a Strong Sell.

Prospects for Tesla just did not look good even if you disregard the damage Elon Musk has done to the company with his political actions.

Before Musk’s political actions that led to many people boycotting Tesla products, Tesla’s electric vehicle (EV) business had already been shrinking.

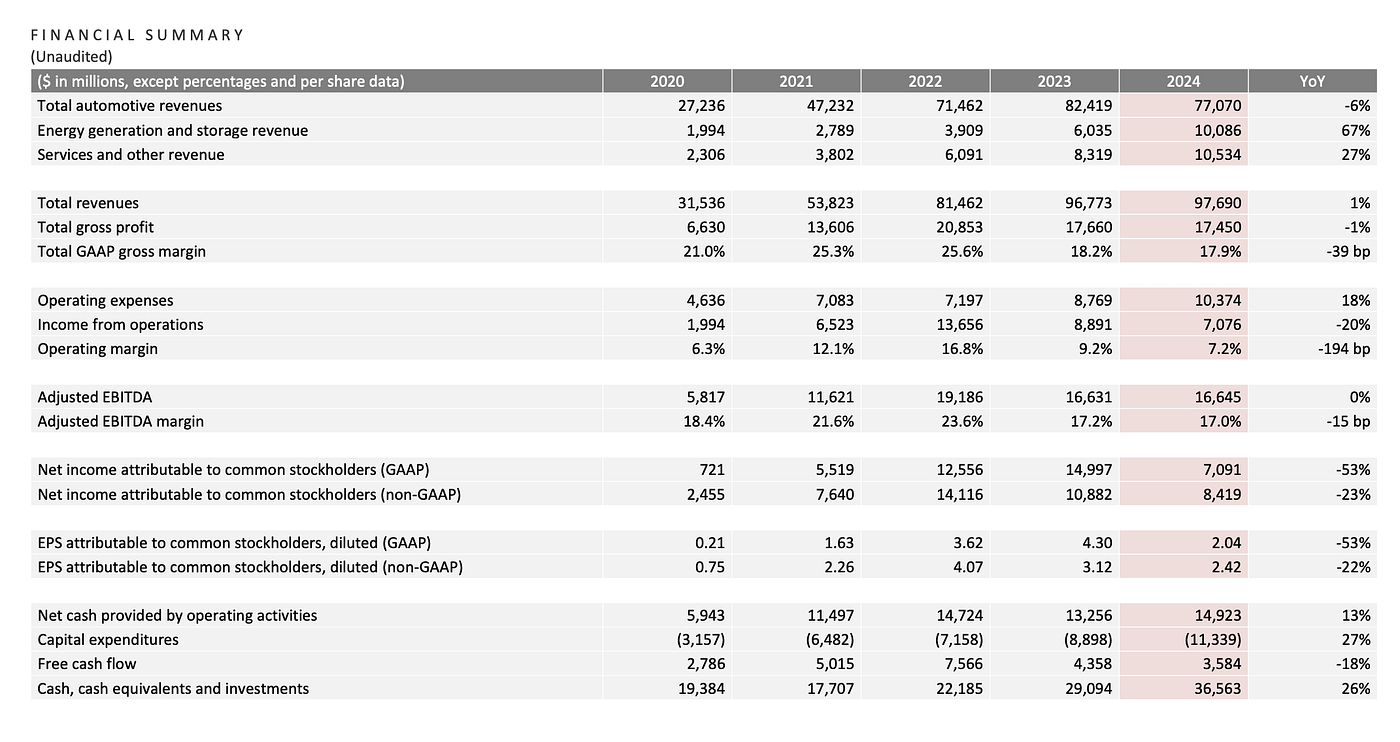

Automotive revenues in 2024 were down 6% compared to 2023, in stark contrast to the previous five years of double-digit revenue growth and we can expect Tesla’s EV business to continue declining.

The reason is that Tesla’s competition has caught up.

A couple of years ago, the choice was between a Tesla and an internal combustion engine (ICE) vehicle.

Now, it’s a choice between Tesla, ICE, and EVs from other auto manufacturers.

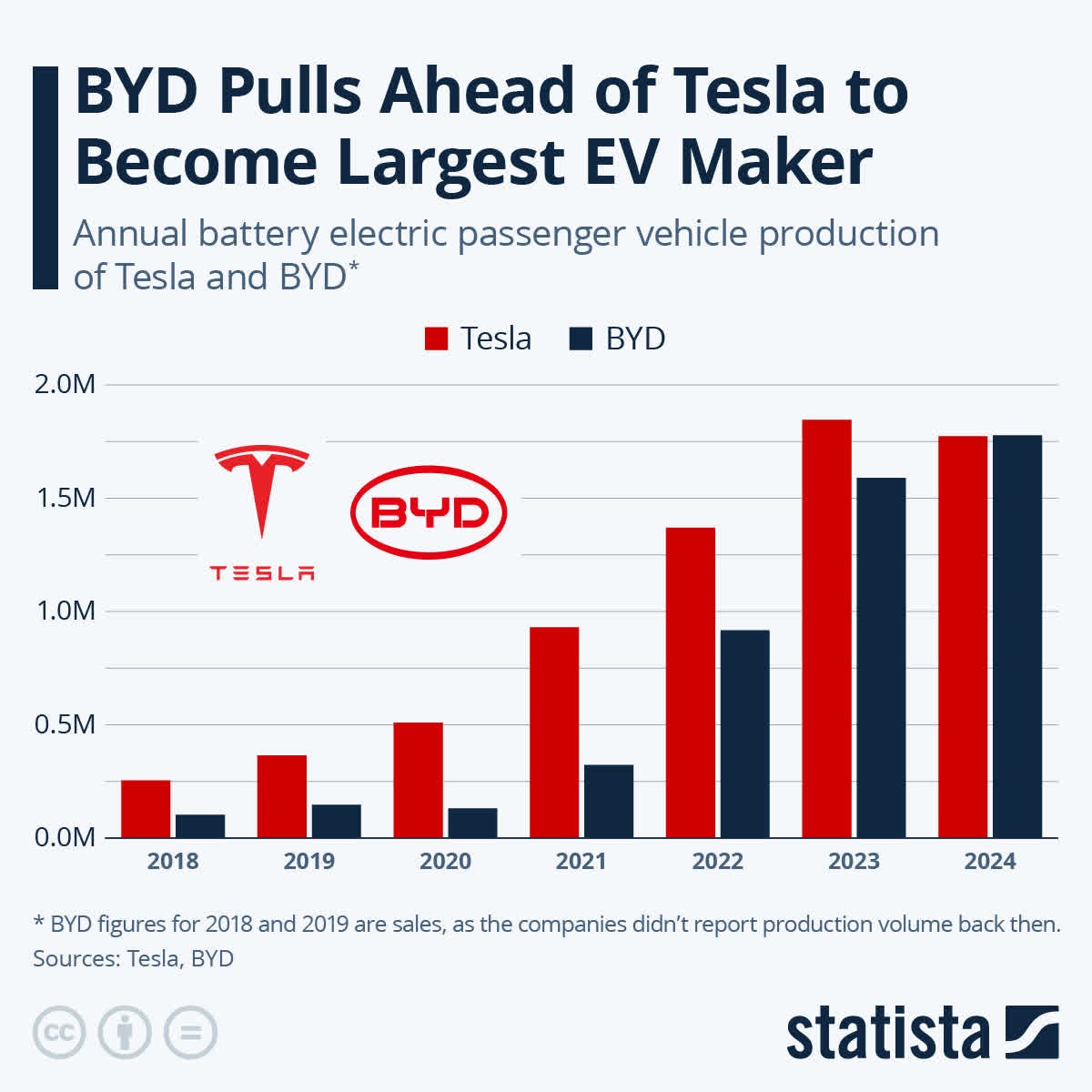

China’s BYD (BYDFF), in particular, has already overtaken Tesla as the world’s largest EV maker, and there’s a plethora of great EV alternatives in China like Li Auto, Xiaomi, Xpeng, and more.

Image From Seeking Alpha

Image From Seeking Alpha

And while Chinese EVs have yet to make a strong mark in the Western Hemisphere due to tariffs, Tesla’s competition only gets more intense daily.

Companies like Mercedes-Benz (MBGAF), General Motors (GM), Ford (F), Volkswagen (VLKAF), and virtually every auto manufacturer have been building their own EV lineups.

These EVs are sometimes flat-out better than a Tesla and in other cases, are competitive choices if the dealer gives a good enough deal.

Our family found ourselves in a similar situation last year when we were in the market for a new vehicle.

We had considered a Tesla, but ultimately bought a Lexus RX450. For my parents, the Lexus offered a better ride experience, and our deal on the Lexus was far better than that of Tesla. We were only paying 2% in interest for the Lexus versus 8–9% at the time for Tesla.

Unfortunately for Tesla, there is very little they can do to amp up their EV business now. The company was at peak EV market share the last few years, but it seems that market share is beginning to get eaten away by competitors, and Tesla’s EV business will become like all the other car brands.

People will only buy Teslas because they really like them, or get a better deal, the same way people choose between Mercedes-Benz and BMW, or Toyota and Honda.

The only way for Tesla’s EV business to regain the spotlight is if they built a car that somehow had double the range of everything else for half the cost, or some other life-changing innovation that makes Tesla cars no-brainer buys.

Tesla bulls may hope this happens, but hope is not a wise investment strategy.

Tesla, An Energy and Infrastructure Dream

Tesla, however, is more than a car company.

Although 2024 automotive revenues fell, overall revenues grew by 1%. The loss was offset by significant growth in Tesla’s energy and service revenues where the respective categories saw 67% and 27% growth.

Image From Seeking Alpha | Tesla Financial Summary 2024

Image From Seeking Alpha | Tesla Financial Summary 2024

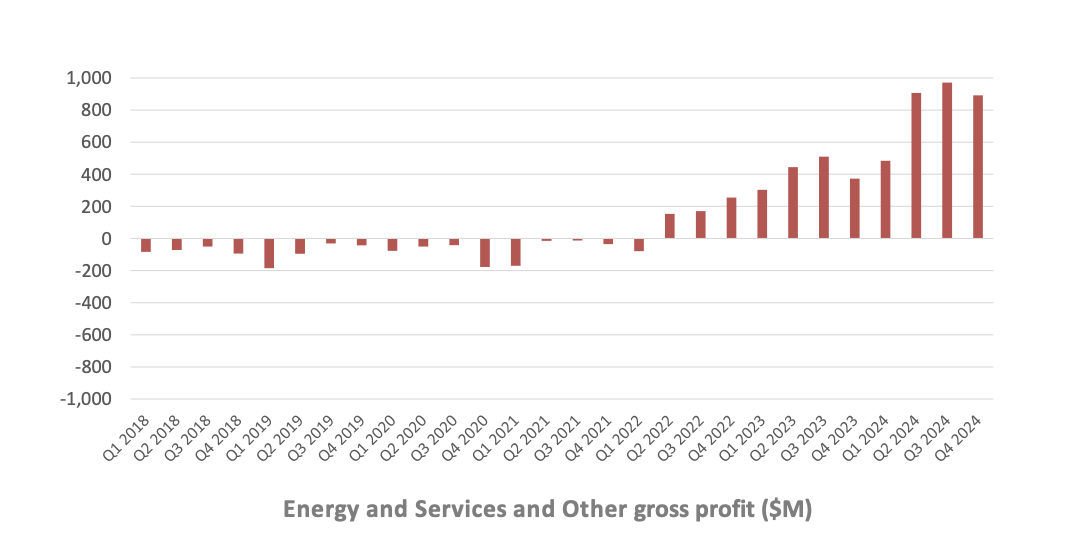

Additionally, 2024 was also the same year Tesla saw significant growth in gross profit for these segments where the once negative margins a few years ago turned positive in 2023 and then essentially doubled in 2024.

Image From Seeking Alpha

Image From Seeking Alpha

From my humble perspective, Tesla could have potentially become the world’s most valuable company if it had focused more on developing energy and infrastructure.

This sentiment comes from the vast amount of energy needed for AI development, cryptocurrency, EVs, and robotics.

If AI is gold and AI development companies are the gold miners, energy is the shovels you sell to the gold miners.

Beyond AI, Tesla would have never had to worry about dropping EV sales if they focused their direction on energy and infrastructure projects.

The company’s Supercharger Network is the largest in the world, but it could have been so much bigger.

Imagine if Tesla’s Superchargers were as regular and frequent as gas stations. There would be minimal reason for other automakers to try to develop their own networks and instead, look to build their cars with Tesla’s Superchargers in mind.

It would be like how millions of different phone brands use Google’s Android operating system despite Google also making their own Pixel phones.

Or like how Windows is a primary operating system, though Microsoft also makes its own Surface devices.

Tesla would have had a much more solid business if it had become a company that other EV makers and AI companies depended on.

But alas, it has decided to go the route of competing against tech behemoths that already have huge leads in AI and self-driving.

Tesla Is Entering the Robocab Business Behind the Market

Instead of focusing efforts on further developing Tesla’s energy and infrastructure businesses, the company actually laid off their Supercharger development team in 2024 to focus on self-driving R&D.

This was a grave mistake, especially considering their approach.

Yes, the self-driving market is projected to be huge, and it would seem like a mistake not to be involved with AI-related projects.

But that’s also exactly why Musk’s robocab network approach will face significant challenges.

Unlike EVs, companies recognize the potential of the self-driving market and have already been spending billions building the technology.

It’s not like a decade ago when car manufacturers tested the EV market and discontinued products due to lack of sales, only to have Tesla be extremely aggressive and innovative to eventually create the EV market themselves.

Today, Tesla’s self-driving is competing against Google’s Waymo and Amazon’s Zoox. Other car manufacturers have also recognized the market trends, with companies like GM partnering with Nvidia for self-driving development and BYD’s own God-Eye program.

Stiffer competition is not the only issue. More concerning for Tesla is that it’s behind companies like Google.

While Tesla has only unveiled prototypes of what could be, Google’s Waymo has already been fully operational and generating revenue.

Yet, Tesla’s stock had been trading three to five times more expensively on a P/E level compared to Google. Actually, the company is trading at multiple times more expensive than Nvidia despite its own self-driving research being powered by Nvidia GPUs.

To me, that just makes no sense.

The overvaluation is further highlighted when I created my discounted cash flow model for Tesla stock. Even with 51% yearly growth in free cash flow, the company is only worth about $130 per share.

You can see my full assumptions and model in my Seeking Alpha analysis linked here.

TSLA Stock — There Are Different Perspectives

For me, Tesla’s stock isn’t attractive, but I cannot predict the future nor will I proclaim to be all-knowing.

There are definitely different perspectives on Tesla as a company, and I always welcome opposing perspectives that may prove me wrong and teach me something new.

This is why I’m a huge fan of Seeking Alpha. You can get a variety of different perspectives on various investments to help you develop your own well-rounded view of whether an investment is worth your money or not.

Tesla’s stock is actually one of the most covered on Seeking Alpha and you can see just how different people’s perspectives are by looking at the latest four articles:

“Tesla: Gap With BYD Might Be Uncoverable” — DT Invest Rates Strong Sell

“Autonomous Driving And Retail Trader Buying Won’t Steer Tesla’s Stock Price” — Oriental Trader Rates Strong Sell

“Tesla Is Transitioning For Industry 4.0 (Rating Upgrade)” — Michael Del Monte Rates Strong Buy

“Tariffs Aren’t As Scary For Tesla: Upgrading To Strong Buy” — The Techie Rates Strong Buy

Financial Disclaimer: The views in this article are the author’s personal views. This commentary is provided for general informational purposes only. It does not constitute financial, investment, tax, legal, or accounting advice or an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this article should consult with their advisor. The information provided in this article has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Their values change frequently, and past performance may not be repeated.

Affiliate Link Disclosure: You may assume all links in this article are affiliate links. If you purchase any product or service through the link, I may be compensated at no extra cost to you.

Originally published on Medium.com. Get a Medium membership and read articles like this one ad-free.

Leave a Reply