About a year ago, I wrote two articles about SVOL, the Simplify Volatility Premium ETF.

SVOL Currently Yields 17.68%; Is This Dividend Sustainable?

SVOL’s Strategy Has Changed. Can It Maintain Its 16.53% Yield?

As you can see from the two article titles, SVOL pays a sizeable monthly distribution and has consistently yielded above 15% yearly, making it an extremely tempting fund for income investors.

In my first few looks at SVOL, I thought the fund’s strategy made sense on paper but was unproven in the real world.

Shorting VIX futures can make a lot of money, but it is also very risky.

Many people like to compare shorting VIX futures to selling insurance.

Under normal conditions, you’ll make money. Every once in a while, however, a major hurricane or other natural disaster could cause huge losses.

It’s the same with shorting VIX futures.

Generally, market volatility comes down over time, so you will be profitable shorting VIX futures most of the time. Every once in a while, however, a volatility spike could completely wipe out your gains.

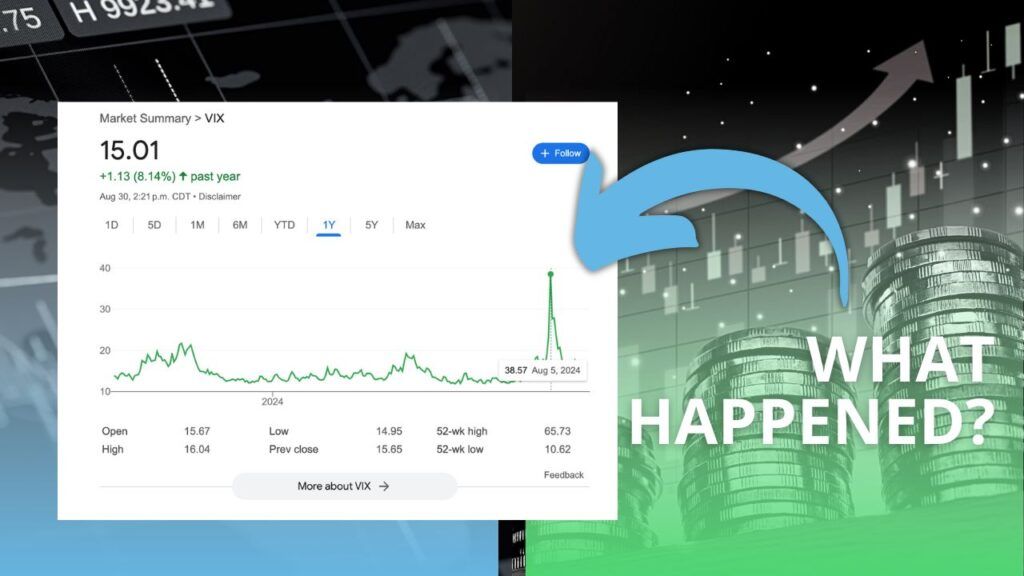

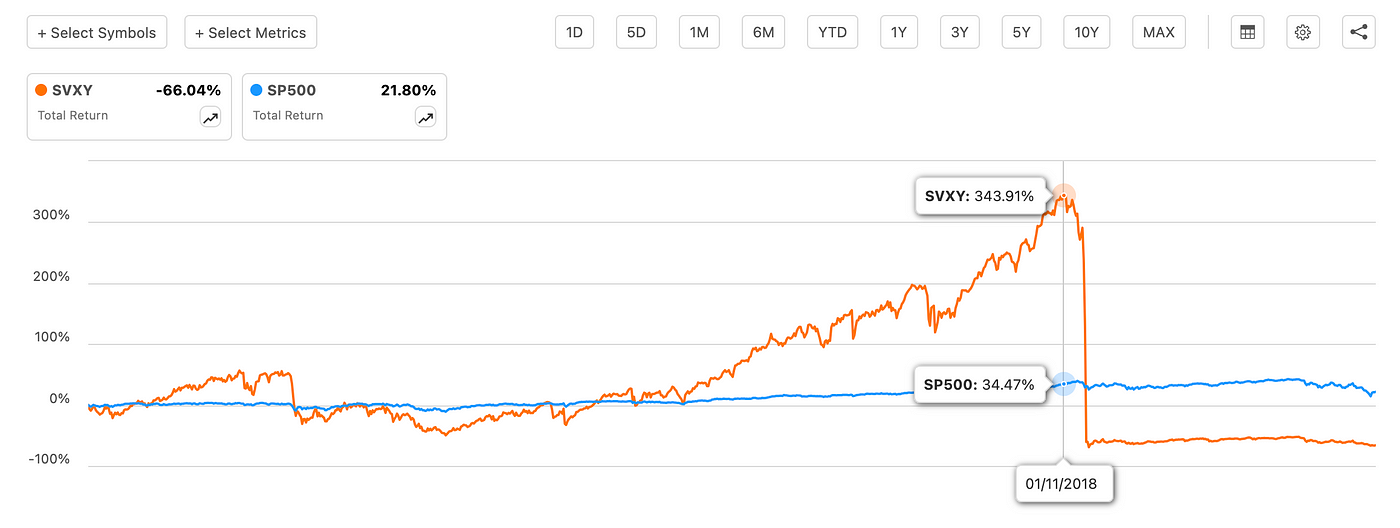

Just look at what happened to SVXY, the ProShares Short VIX Short-Term Futures ETF:

Image From Seeking Alpha | SVXY Vs. S&P 500 Total Return 2015–2019

Image From Seeking Alpha | SVXY Vs. S&P 500 Total Return 2015–2019

In February 2018, the VIX spiked 216% after a weekend and crushed investors who were shorting VIX futures. Thus, investors who remember this occurrence are very wary of SVOL for a good reason.

Before this year, we had no notable VIX spikes, so I recommended holding only as much money as you’re okay with losing in SVOL. In other words, consider SVOL a speculative fund.

After this year’s events, however, I’ve become more confident in SVOL and believe this is a fund worth holding if you’re an income investor.

The Japanese Yen Carry Trade That Blew Up The Market

On August 5, 2024, SVOL had its first real test.

The Bank of Japan raised interest rates by 15 basis points, causing a widespread carry trade to unwind and a global selloff.

For some background, a carry trade is a strategy where you borrow money at a low interest rate to reinvest in an asset with a higher rate of return.

Since the Japanese Yen could be borrowed at near-zero interest rates, people often borrowed Yen to be reinvested in other assets.

This strategy only became more popular as other countries, such as the United States, began raising interest rates.

Theoretically, you could borrow Japanese Yen at near-0% interest rates, put your money in 5% U.S. treasuries, and seemingly profit at no risk since the Bank of Japan has kept interest rates at 0% or negative for over 20 years.

But then Japan did the unthinkable and raised interest rates twice in a short time period, which caused massive panic for those involved in the Yen carry trade.

The VIX jumped 165% in a single day, which is comparable to the single-day jumps during the 2008 Financial Crisis.

You’d expect SVOL to suffer significantly from this occurrence, but the fund actually held up quite well.

The Defense Mechanisms Of SVOL

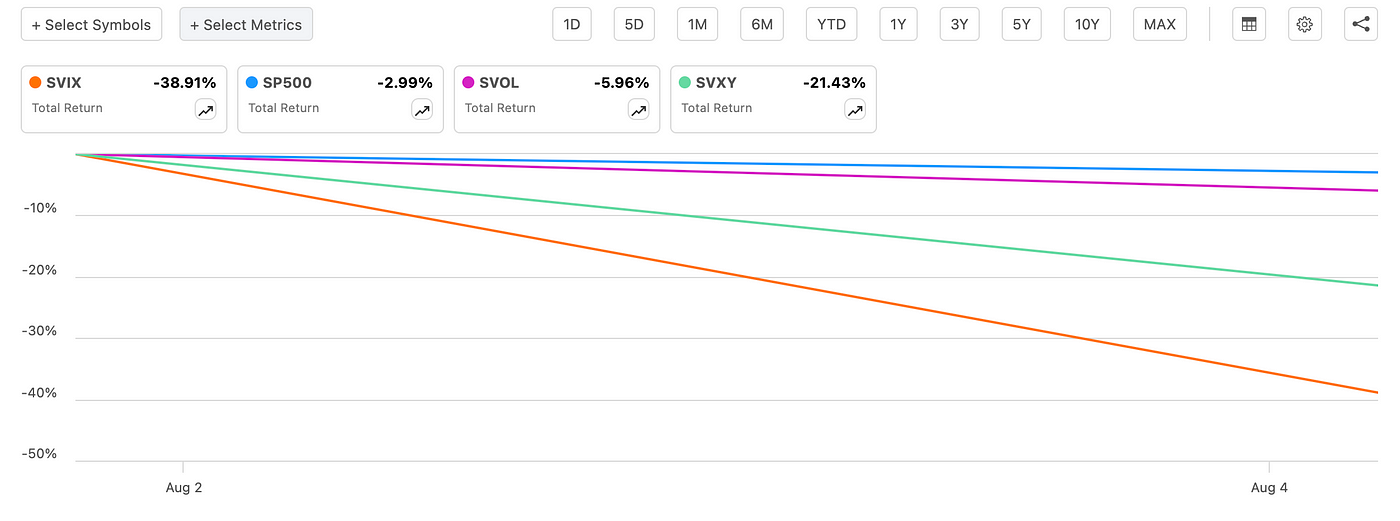

On August 5, 2024, SVOL lost about 6% compared to the S&P 500’s 3%. This is very good considering that other short VIX futures funds like SVXY and SVIX lost 21.43% and 38.91%, respectively.

Image From Seeking Alpha | SVOL Vs. SVIX, S&P 500, and SVXY August 2–5, 2024

Image From Seeking Alpha | SVOL Vs. SVIX, S&P 500, and SVXY August 2–5, 2024

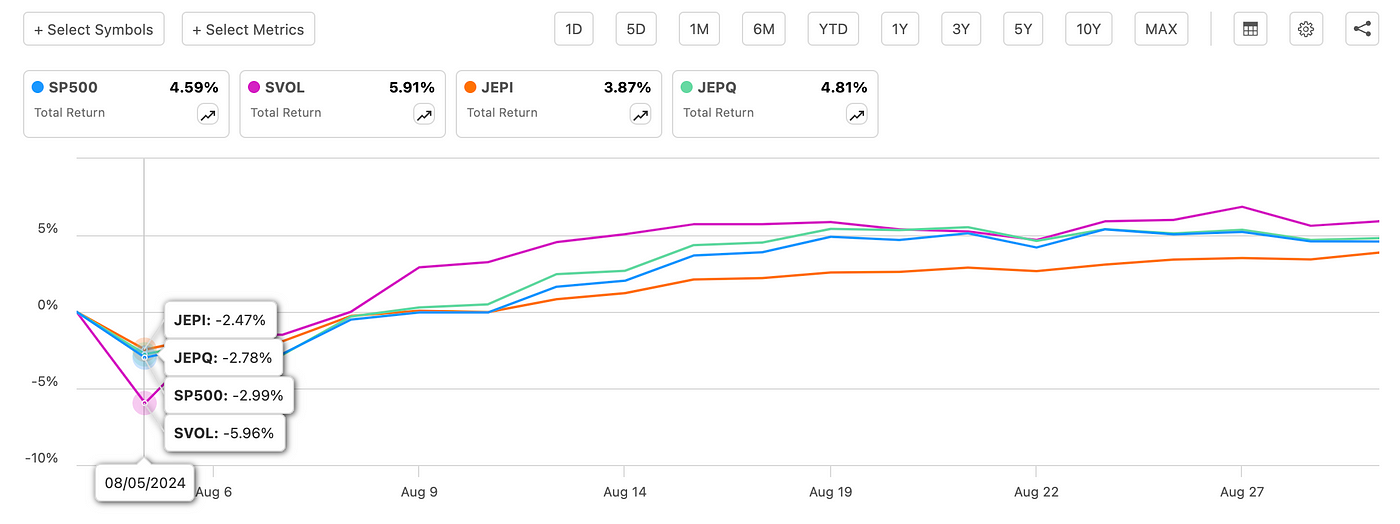

Additionally, SVOL has done well to recover, outperforming the S&P 500 and income funds like JEPI and JEPQ since the volatility spike.

Image From Seeking Alpha | SVOL Vs. S&P 500, JEPI, and JEPQ Total Return August 2–30, 2024

Image From Seeking Alpha | SVOL Vs. S&P 500, JEPI, and JEPQ Total Return August 2–30, 2024

The first thing to mention is that SVOL only seeks to provide investment results corresponding to approximately 0.2x to 0.3x the results of shorting VIX futures, while funds like SVXY and SVIX short 0.5x and 1x, respectively.

This alone is a significant reason why SVOL did not take as big a hit as the other funds, but it’s not the whole story.

Theoretically, if SVOL only shorted VIX futures, its performance would be between 40% and 60% that of SVXY.

Yet, SVOL’s drop actually comes out to be 27.8% of SVXY.

There are a few reasons for this loss mitigation.

First, SVOL buys protective VIX future call options to protect the fund from volatility spikes, such as the one that happened on August 5.

This is SVOL’s primary protection where essentially all its losses are capped at the call options’ strike price.

In addition to VIX call options, SVOL buys protective puts and call options on other assets. While the exact methodology for choosing these assets is unknown, the idea is to diversify from VIX futures and keep more income.

Since shorting VIX futures has been proven to be a very profitable but risky venture, many people have the same idea to short the VIX futures while buying long VIX call options as protection.

The more people that do this, however, the less money investors will gain from selling a VIX future and the VIX call options will cost more due to supply and demand.

SVOL can alleviate some pressure by buying protection through puts and calls on other assets. For example, since a VIX spike is largely correlated with a sudden selloff in the stock market, buying an S&P 500 put option has a similar effect to buying a VIX call option.

The Cost Of Protection

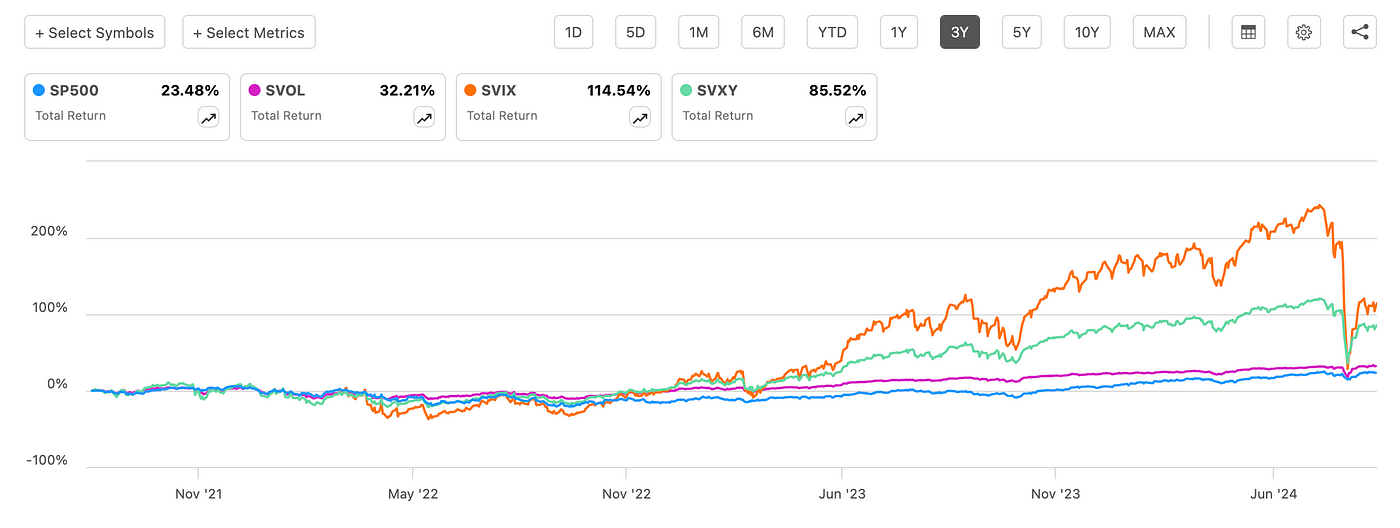

Protection against volatility spikes does come at a cost, though. All these protective puts and calls cost money, and we can really see how it hinders SVOL’s performance as a short VIX futures fund.

Image From Seeking Alpha | SVOL Vs. S&P 500, SVIX, and SVXY Total Return Last 3 Years

Image From Seeking Alpha | SVOL Vs. S&P 500, SVIX, and SVXY Total Return Last 3 Years

The beauty of SVOL, however, is that it’s less of a VIX futures fund, and investors are more focused on how it generates income.

And when it comes to income, SVOL certainly does a great job.

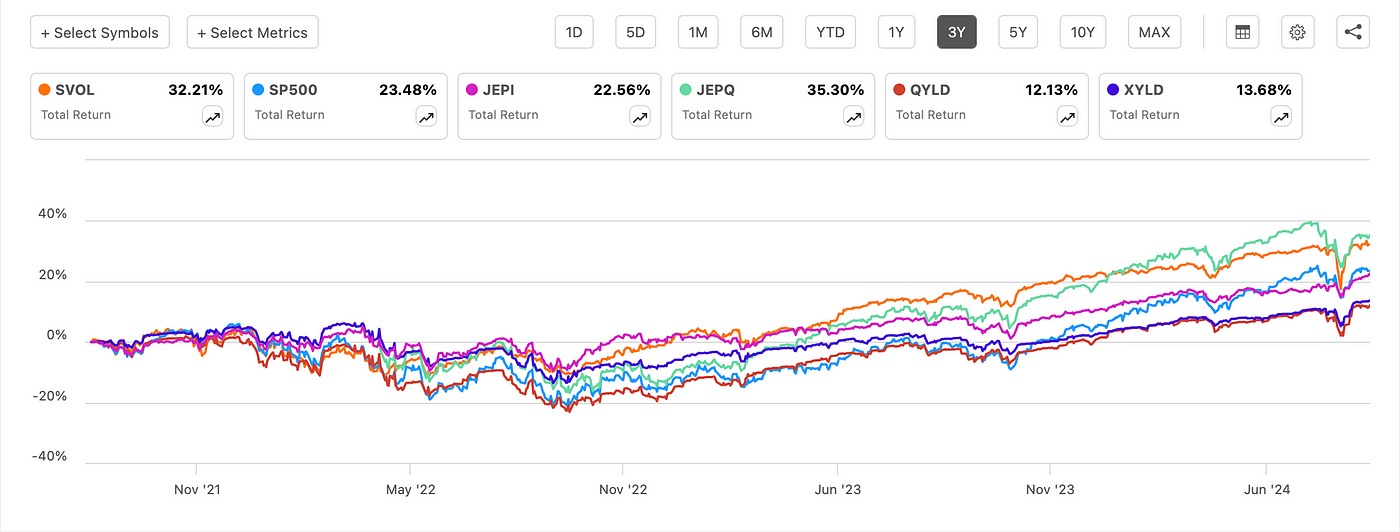

Image From Seeking Alpha | SVOL Vs. S&P 500, JEPI, JEPQ, QYLD, and XYLD Last 3 Years

Image From Seeking Alpha | SVOL Vs. S&P 500, JEPI, JEPQ, QYLD, and XYLD Last 3 Years

In the last three years, SVOL has outperformed many popular income funds, such as JEPI and JEPQ, over various timespans.

What’s notable, however, is that SVOL has done this with a 15%+ yield compared to the 7%-10% you get from JEPI and JEPQ.

That being said, SVOL has its problems.

Its ability to withstand a volatility spike does not mean you should put all your money into this fund.

A VIX spike will still cause this fund to lose money, and it’ll do poorly if the VIX slowly goes up.

Simplify, as a fund management company, has also had issues in the past with its other funds, such as FIG and HIGH.

HIGH: Be Careful With This 9.18% Yielding Cash Alternative

In one instance, Simplify was trading speculative Carvana options near Carvana’s earnings report in their FIG fund, which raised significant questions about Simplify’s credibility.

With a fund like SVOL, Simplify has near-infinite power.

For example, in its prospectus, Simplify states:

The Fund pursues its strategy primarily by purchasing ETFs that invest principally in the U.S. investment grade bonds of the U.S. government, corporate issues, and MBS. However, the Fund invests without restriction as to the credit quality, maturity, or duration of an individual security.

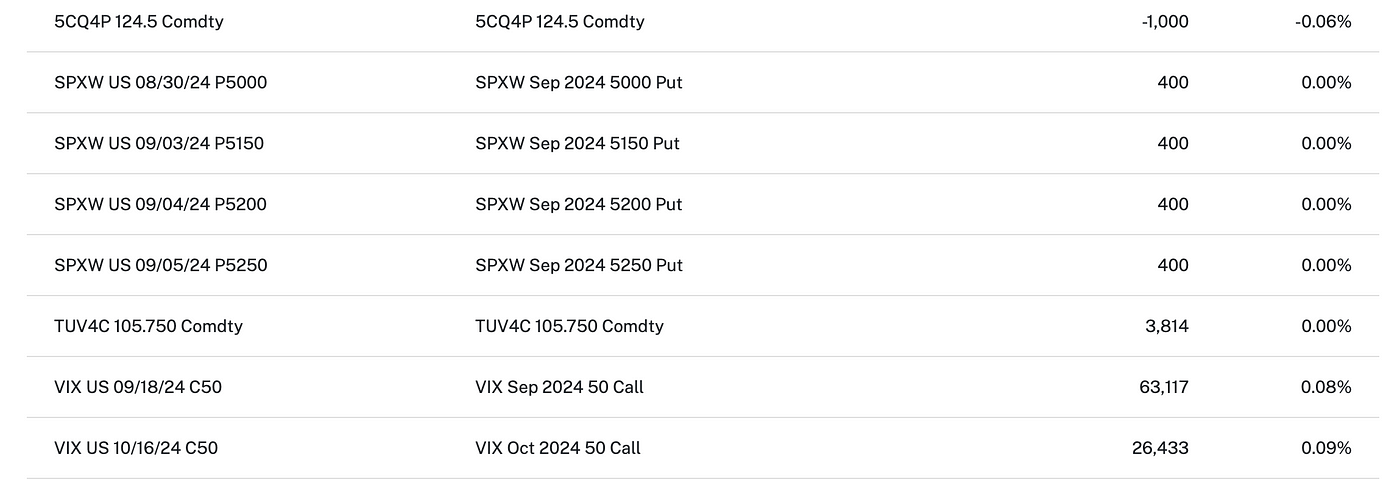

Looking at SVOL’s holdings, you’ll see that the ETF holdings are bonds… plus other things.

Take AGGH, which occupies 9.32% of SVOL’s portfolio. The following is from Simplify’s website:

The Simplify Aggregate Bond ETF (AGGH) seeks to maximize total return.

The fund is actively managed to create a core bond exposure with enhanced yield via structural income opportunities such as more efficient curve positioning and defined-risk option writing.

So yes, AGGH is a bond holding but with several strategies layered on top. The same goes for many of the options strategies executed within SVOL.

The fund specifies that it will use derivatives but always gives itself complete freedom over what they’re buying.

This is some of their holdings as of August 30, for example:

Image From Simplify

Image From Simplify

What you’ll notice is that they have commodity options mixed in. I’m not 100% sure what they’re for, but all I can do is trust what Simplify is doing.

Putting all your faith in the fund managers is the reality of investing in SVOL. It’s basically the same as investing in a hedge fund.

So far, Simplify has done well with SVOL, but you can never be too careful with these types of funds.

SVOL Is A Great Addition, But Not A Core Holding In Your Income Portfolio

Overall, however, there is no denying SVOL’s performance. Outperforming the S&P 500 after its high 1.16% expense ratio and paying a 15%+ monthly distribution makes SVOL an income investment definitely worth looking into now that we’ve seen its performance in a volatility spike.

I wouldn’t put all my money or make SVOL a core holding, though.

The fund still has weaknesses and should be paired with other income funds for safety. Personally, I would be comfortable putting 10–15% of my income portfolio in SVOL and no more than 20%.

Of course, your situation could be different, and I’d always recommend doing more research. If you’re looking for more info on SVOL, Seeking Alpha is one of the best places to go for analysis and data.

Want more investment coverage and analysis? Check out the list below for my complete collection of articles analyzing various stocks and ETFs!

Stock and ETF Analysis

Financial Disclaimer: The views in this article are the author’s personal views. This commentary is provided for general informational purposes only. It does not constitute financial, investment, tax, legal, or accounting advice or an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this article should consult with their advisor. The information provided in this article has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Their values change frequently, and past performance may not be repeated.

Affiliate Link Disclosure: You may assume all links in this article are affiliate links. If you purchase any product or service through the link, I may be compensated at no extra cost to you.

Originally published on Medium.com. Get a Medium membership and read articles like this one ad-free.

Leave a Reply