Almost everyone, including myself, recommends investing in a low-cost S&P 500 index fund over the long run.

However, the long run is the keyword, and we’re not talking about five or even ten years.

No, we’re looking much further at 20, 30, or even 40 years.

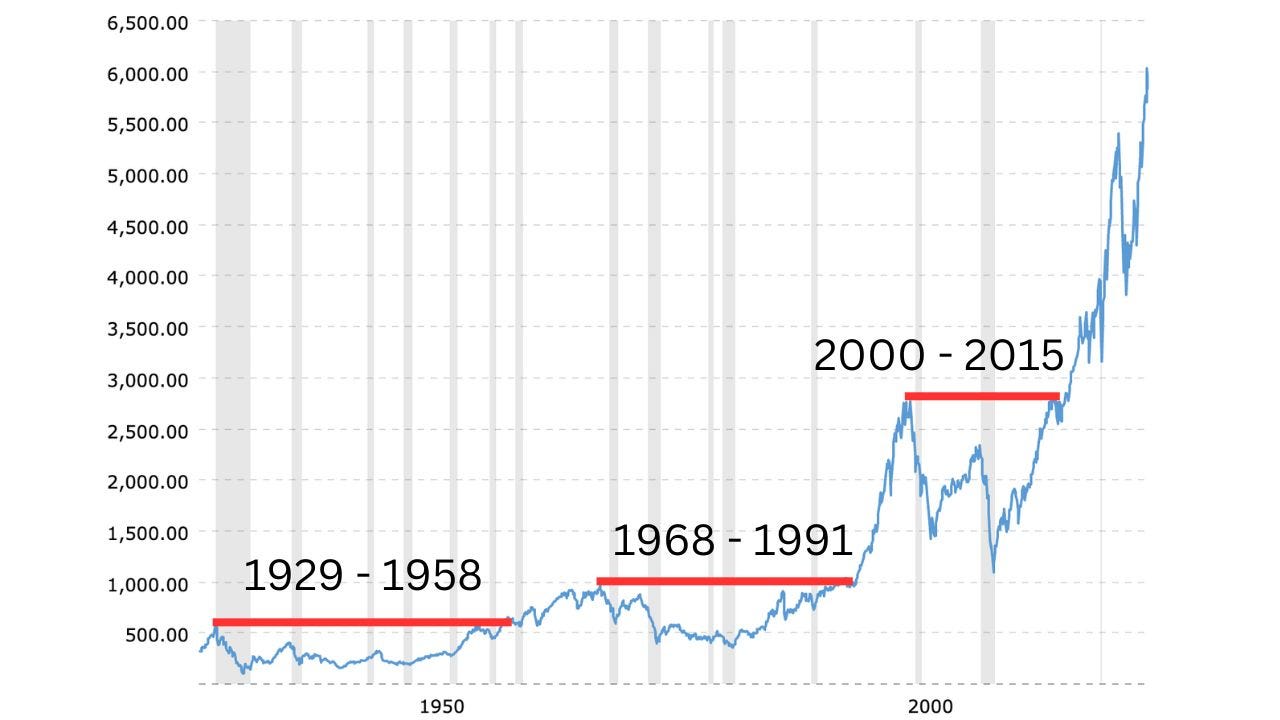

I want you to take a look at the chart below:

Chart From MacroTrends

Chart From MacroTrends

This is a 90-year historical price chart of the S&P 500 adjusted for inflation from MacroTrends. The grey strips represent recessions, and I have noted periods when the S&P 500 took significant time to recover back to their all-time highs.

After looking at the chart above, you’ll see why the S&P 500 is not always the best investment.

If you were unlucky enough to invest at the peak of the market before a major crash, you could end up waiting possibly 30 years before the market returns to where it originally was.

It is a very scary thought to look at the same chart and realize that the outer edge on the right shows where we are today.

We had a once-in-a-lifetime pandemic and a bear market in 2022, but those do not compare with crashes like the 2008 Financial Crisis or the Great Depression that took years to recover from.

Are we to expect that these large crashes do not exist anymore? Did we solve the economy?

It’s a wonderous thought, but to actually believe that we did would be foolish.

People have learned from history, and innovations have certainly improved our ability to deal with problems we once had. However, these new innovations and learnings will also create new issues that we never had to deal with before.

We don’t know when or how a crash might happen, but we can reasonably expect that a large market crash will occur at least once in our lifetimes.

What Time in the Market Really Means

Now, you may have heard the saying:

“Time in the market beats timing the market.”

The idea is that you don’t know when the market will hit its lows or its highs, and you will make more money just by riding out the market rather than trying to enter and exit at the right times.

This general statement holds true, but you must understand where it comes from.

In the case of the S&P 500, it’s dividends.

When I was researching the Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF (QDPL), I came across a study showing that dividends account for more than 50% of the S&P 500’s total returns over the long term despite offering only 1–3% returns in a single year.

QDPL: Get S&P 500 Returns With 4X Its Dividends

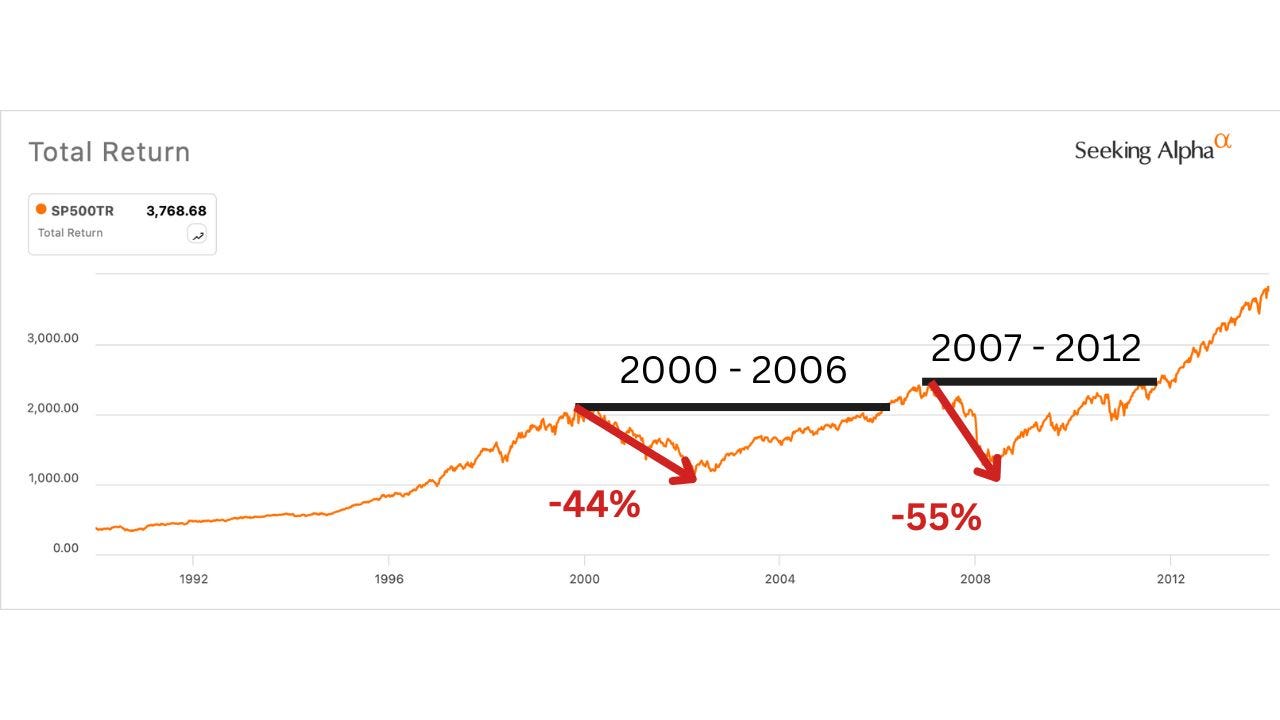

And we can confirm this by looking at the S&P 500’s total returns, including dividends and reinvestment.

Chart From Seeking Alpha

Chart From Seeking Alpha

Unfortunately, I wasn’t able to study data back to 1929. However, the benefits of dividend reinvestment can already be seen when comparing the total returns between 2000 and 2015 to price returns.

With dividend reinvestment, you would have recovered your principal six years after the Dotcom Crash. Although you would have experienced another crash about two years later, you would have recovered your money in 2012 versus waiting until 2015.

When you consider that you should also be dollar-cost-averaging and adding money consistently, market crashes become less significant.

But what if you can’t do that? I, for one, did not have a consistent income and still do not.

In 2021 and 2022, I made more than $10K monthly. In 2023 and 2024, I made minimum wage.

Can you reasonably expect one to be able to consistently reinvest and dollar-cost-average regardless of market conditions for more than 20 years straight?

Hard to say and even more difficult when you consider factors like age.

If you are 50 and considering retirement soon, it would be inconsiderate of people to expect you to ride out and reinvest during a market crash that lasts more than 20 years.

It’s these situations where the S&P 500 does not necessarily make much sense — the situations where you cannot reasonably expect yourself to reinvest consistently regardless of market conditions over decades.

Focus on Cashflow

Let’s say you had a million dollars. You have two options.

You can buy a piece of artwork that could be worth $2 million in the next year.

The other option is to buy a business that makes $100K per year in profit.

While you can perhaps take loans against a piece of artwork or similar assets, those loans have to be paid back. What happens if your asset loses half of its value and you’re unable to pay back your loans?

The business, however, may lose half of its value next year, but I don’t think you would care as long as it’s still making you $100K or more in profit per year.

This is the fundamental of dividend and value investing.

When you invest for earnings and cash flow, a stock’s price is simply what you pay. As Warren Buffett once said:

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” — Warren Buffett

When the markets are at their all-time highs, I have become more focused on dividends and income than ever. As when a market crash does ultimately happen, it does not change anything for me except incite me to invest more.

Of course, being a good value and dividend investor requires you to do much more due diligence. My personal first stop when researching any investment is this platform and you can also find some of my exclusive articles on various investments here, too.

Financial Disclaimer: The views in this article are the author’s personal views. This commentary is provided for general informational purposes only. It does not constitute financial, investment, tax, legal, or accounting advice or an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this article should consult with their advisor. The information provided in this article has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Their values change frequently, and past performance may not be repeated.

Affiliate Link Disclosure: You may assume all links in this article are affiliate links. If you purchase any product or service through the link, I may be compensated at no extra cost to you.

Originally published on Medium.com. Get a Medium membership and read articles like this one ad-free.

Leave a Reply