Given Nvidia’s recent success, my mother has often shown us how her $10K investment in the company a couple of years ago is now worth over $600K.

Nvidia is single-handedly making my parents millionaires, and my brother often wonders why I didn’t have him invest in NVDA a few months back.

Regrets like these are common in investing.

You see investments like NVDA, Bitcoin, and others skyrocket and wish you had invested money.

It’s made me think about my own investing regrets and I realized I don’t think the same way.

Despite all the news regarding NVDA and other AI companies, I have not regretted my decision not to invest in them.

In fact, I had recommended that my parents sell their NVDA position months ago when their holdings were worth $300K.

It was good that they did not listen to me, but I still stand by my recommendation. If NVDA continues to grow and my parents continue to double or triple their money, then I have stuff to look into to become a better investor.

If I win, I win. If I lose, I learn… unless I lose off of listening to others.

The only times I regret my investing decisions are when I have an idea but decide against it when other factors sway me out of investing.

This could be people trying to convince me against a particular investment or reading other people’s analyses.

Don’t get me wrong, other people’s opinions and perspectives are important, but you can’t let others decide for you.

In the past couple of months, I have wanted to invest in three stocks but didn’t for various reasons, and I now regret those decisions.

Here are those three stocks.

Adobe Inc. (ADBE) — Generative AI in the World’s Largest Creative Suite

ADBE is a company I have been keen to invest in since the AI boom started.

There’s no doubt AI will and is changing the world. Everyone knows that, which is why stocks like NVDA have experienced explosive growth.

In a gold rush, when everyone is digging for gold, I prefer to be the one selling shovels.

This is why I have avoided stocks like NVDA and have been looking for opportunities where companies can significantly benefit from AI’s effects.

For example, one of my favorite stocks continues to be COUR. The company behind the ticker symbol is Coursera.

Despite its continual decline in the last few months, I believe it will perform well in the future as AI ultimately changes the job industry and causes people to pursue education for career switches.

You can read more about my reasoning for COUR in this article:

This Tech Stock Is Down 45.20% in the Last Six Months; It’s a Golden Buying Opportunity

For a similar reason, I have liked Adobe’s position.

Adobe is the biggest company in the creative software world. If you’re a graphic designer, video editor, illustrator, or photographer, knowing how to use the Adobe Creative Suite software is a must-have skill.

Combine this with how generative AI is taking over the world, and you’ll see a tremendous opportunity for Adobe to capitalize.

When generative AI is added to software like Photoshop, Illustrator, and Premiere Pro, the tools suddenly become even more powerful.

The only reason I didn’t consider ADBE more seriously before was that I had read an analysis about how Adobe had trouble monetizing AI.

But it turns out that wasn’t much of a problem.

ADBE’s Q2 results caused the stock to jump 15% in one day, showing that Adobe has been adapting to the AI landscape just fine.

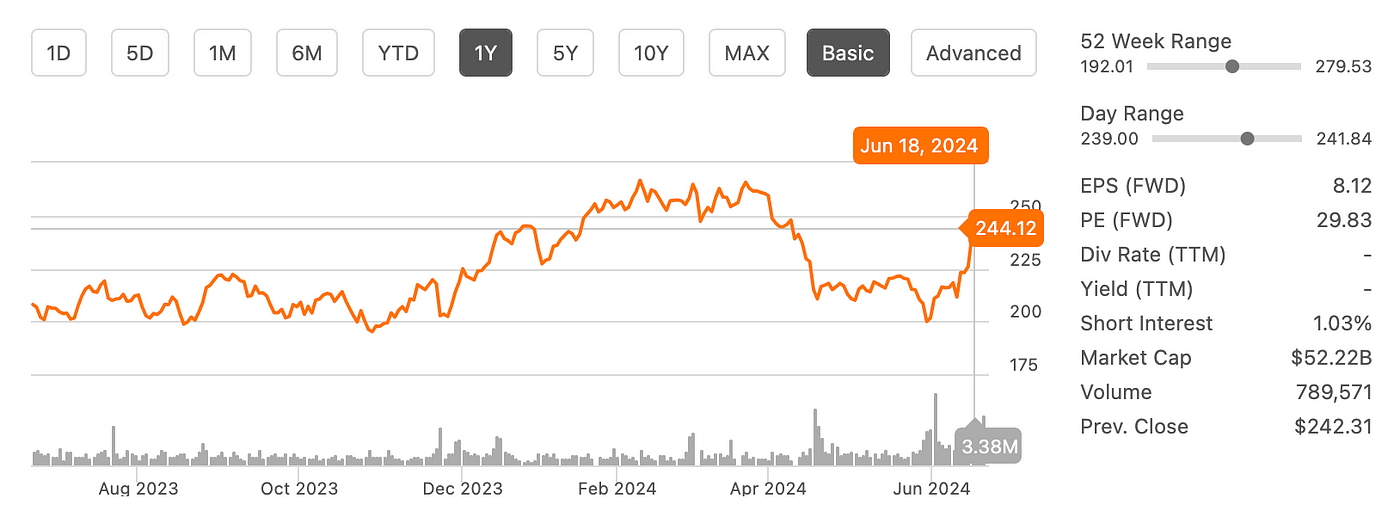

Image From Seeking Alpha | ADBE YTD Price Chart

Image From Seeking Alpha | ADBE YTD Price Chart

Autodesk, Inc. (ADSK) — Generative AI In CAD

For the same reason as Adobe, I also like ADSK.

Autodesk is in a similar position as Adobe but in the CAD space instead.

Programs like AutoCAD and Revit are must-knows for architects, engineers, and 3D modelers. Generative AI will only make these programs even more powerful.

Think about how fast an architect’s workflow could become when AI generates all the basic floorplans and drafts that you used to have to draw manually.

Again, I didn’t buy into the stock, seeing as other analysts talked about Autodesk being overvalued.

However, just like ADBE, the stock shot up after beating Q2 expectations, and it is a company I would love to hold over the long term.

Image From Seeking Alpha | ADSK YTD Price Chart

Image From Seeking Alpha | ADSK YTD Price Chart

Yonex Co Ltd (TYO: 7906) — A Bet on Badminton

Steering away from AI, one of the companies I want to invest in the most is Yonex Co Ltd. This is actually a Japanese company listed on the Tokyo Stock Exchange with the ticker 7906.

If you’re a badminton player, you’ve probably heard of Yonex. This company is the biggest player in the market.

Nearly every player I know uses Yonex equipment, and they’re by far the biggest sponsors of the world’s top badminton athletes.

The company is like Apple but for badminton. It’s a premium brand that everyone wants.

The only argument against Yonex is that badminton is very small in some of the biggest consumer markets, such as the United States, Canada, and the United Kingdom.

This, however, is rapidly changing.

Badminton is becoming increasingly popular in the countries listed above. Additionally, the countries where badminton is among the most popular sports, like India, Indonesia, and Malaysia, have seen significant economic growth in the last few years.

Beyond badminton, Yonex has expanded into gold, running, tennis, and snowboarding. The company has the potential to rival top sports companies like Nike and Adidas.

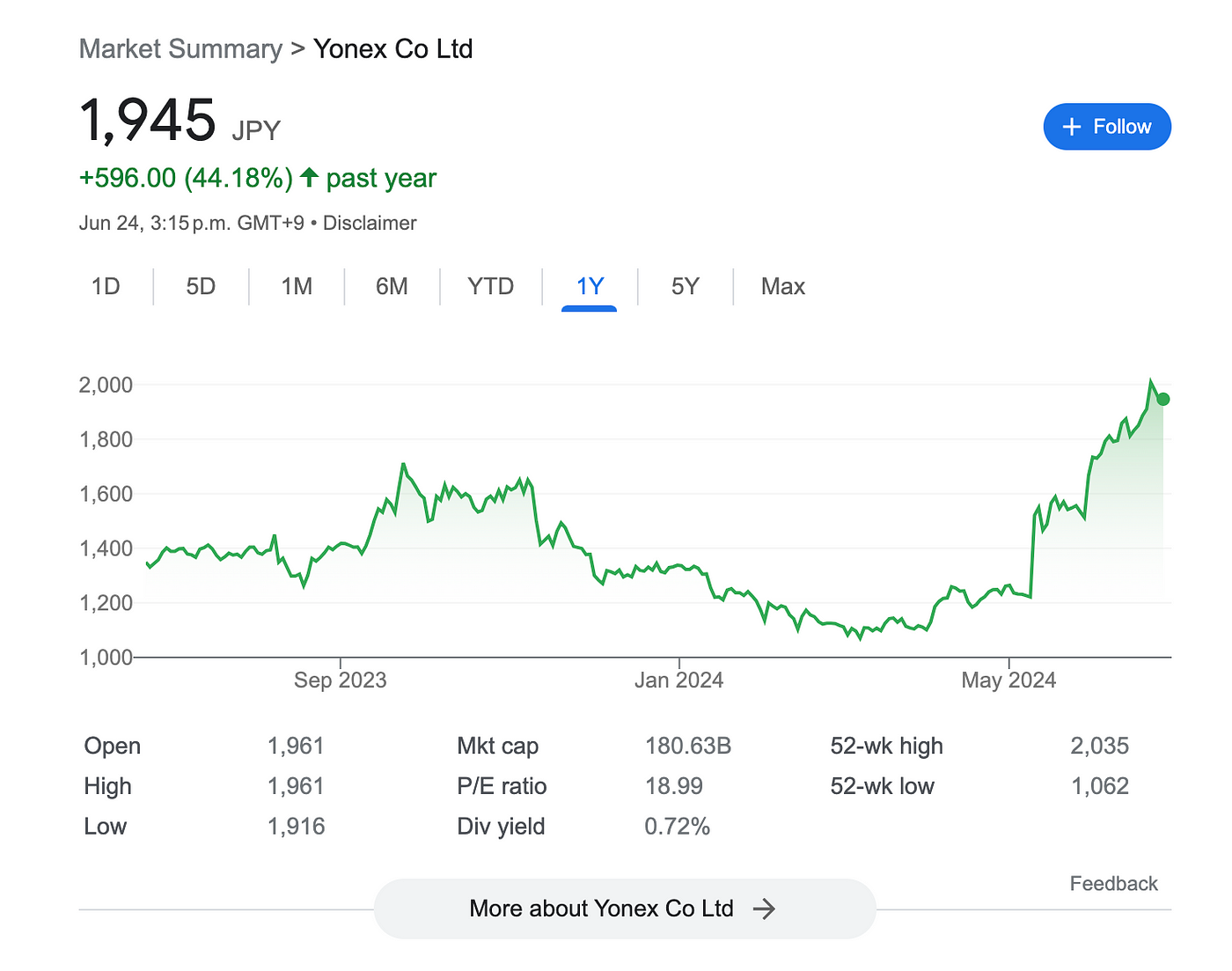

Image From Google | Yonex Stock Price Past Year

Image From Google | Yonex Stock Price Past Year

Why have I not bought this stock, then?

Well, I would love to, but first, I need to overcome the complications of foreign investment.

Ideas For Your Own Investments

Seeing how I personally would like to invest in these three companies isn’t necessarily a signal for you to do the same.

Instead, I would like you to use this article as inspiration to find your own stock picks.

For example, I like Adobe and Autodesk because I use their products myself and know how game-changing generative AI could be for these software companies.

Yonex is one of my favorite companies because I know its dominance in the sport I play.

Think about your own life and what companies impact you. That’s a great starting point for finding profitable investments for your future.

Want more investment coverage and analysis? Check out the list below for my complete collection of articles analyzing various stocks and ETFs!

Stock and ETF Analysis

Financial Disclaimer: The views in this article are the author’s personal views. This commentary is provided for general informational purposes only. It does not constitute financial, investment, tax, legal, or accounting advice or an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this article should consult with their advisor. The information provided in this article has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Their values change frequently, and past performance may not be repeated.

Affiliate Link Disclosure: You may assume all links in this article are affiliate links. If you purchase any product or service through the link, I may be compensated at no extra cost to you.

Visit us at DataDrivenInvestor.com

Subscribe to DDIntel here.

Join our creator ecosystem here.

DDI Official Telegram Channel: https://t.me/+tafUp6ecEys4YjQ1

Follow us on LinkedIn, Twitter, YouTube, and Facebook.

Originally published on Medium.com. Get a Medium membership and read articles like this one ad-free.

Leave a Reply