If you’re an income investor, you’ve probably heard of YieldMax by now, with its massive yields from its individual stock synthetic-covered call strategies.

For example, ETFs like TSLY, CONY, and NVDY are all funds from YieldMax, sporting respective yields of 48.00%, 99.36%, and 105.33%.

Whether you like these funds or not, they certainly are popular.

Since its inception in 2022, TSLY has amassed over $700M in AUM, leading YieldMax to launch 26 other funds with similar concepts.

Inevitably, competitors will see YieldMax’s success and see if they can take a piece of the pie following a similar strategy.

One such competitor is Kurv.

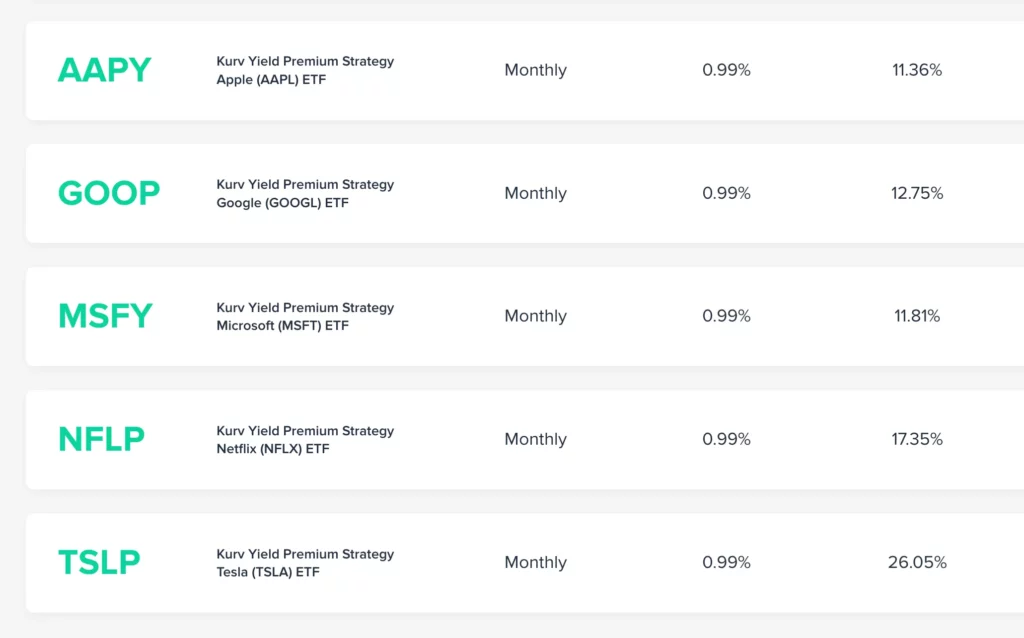

Kurv launched its version of TSLY late last year along with five other ETFs that write covered calls on individual stocks.

Can Kurv compete against YieldMax? Let’s find out.

Finding the Optimal Balance of Capital Appreciation and Income

Kurv’s investment strategy is the same as YieldMax’s but focuses more on finding an optimal balance of capital appreciation and income.

Both fund managers run synthetic covered calls on individual stocks.

For example, both TSLP and TSLY synthetically hold long positions of TSLA stock by simultaneously buying call options and selling put options at the same price.

They then sell additional covered calls to generate the monthly premiums.

For more information on how covered calls work, I highly recommend reading the following article:

An Introduction To Covered Calls And How Ultra High Yield Funds Achieve 10%+ Yields

What makes Kurv a little different is the fund managers will be more active in adjusting their trades to allow for more capital appreciation and the cost of a little less yield.

Selling covered calls is a strategy that fundamentally caps your upside.

You can adjust the amount of upside you participate in by changing the option’s moneyness. The more out-of-the-money you go (the higher the stock price), the more capital appreciation you can get.

This, however, comes at the tradeoff of lower option premiums.

TSLP and its flexible synthetic covered call currently yield 26.05%. TSLY yields 48%.

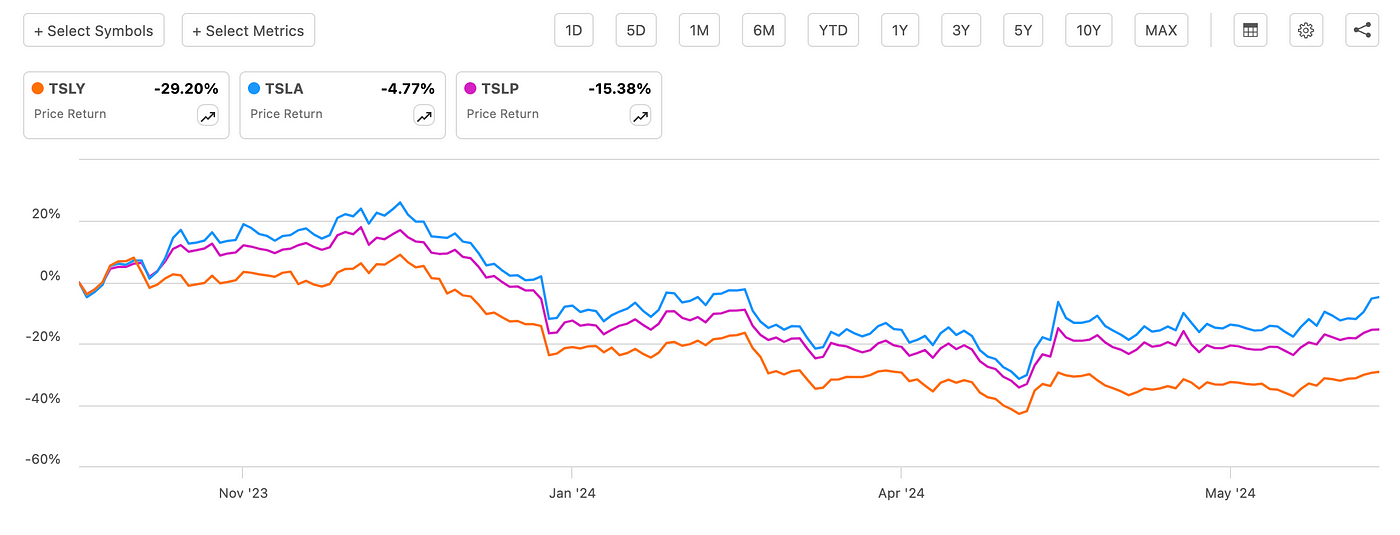

The good news is this lower yield has led to better price returns.

Since its inception, TSLP’s price has been down 15.38% compared to TSLY’s 29.20%, and a similar story can be told across all Kurv and YieldMax comparables.

Image From Seeking Alpha | TSLP Vs. TSLY and TSLA Price Return Since October 2023

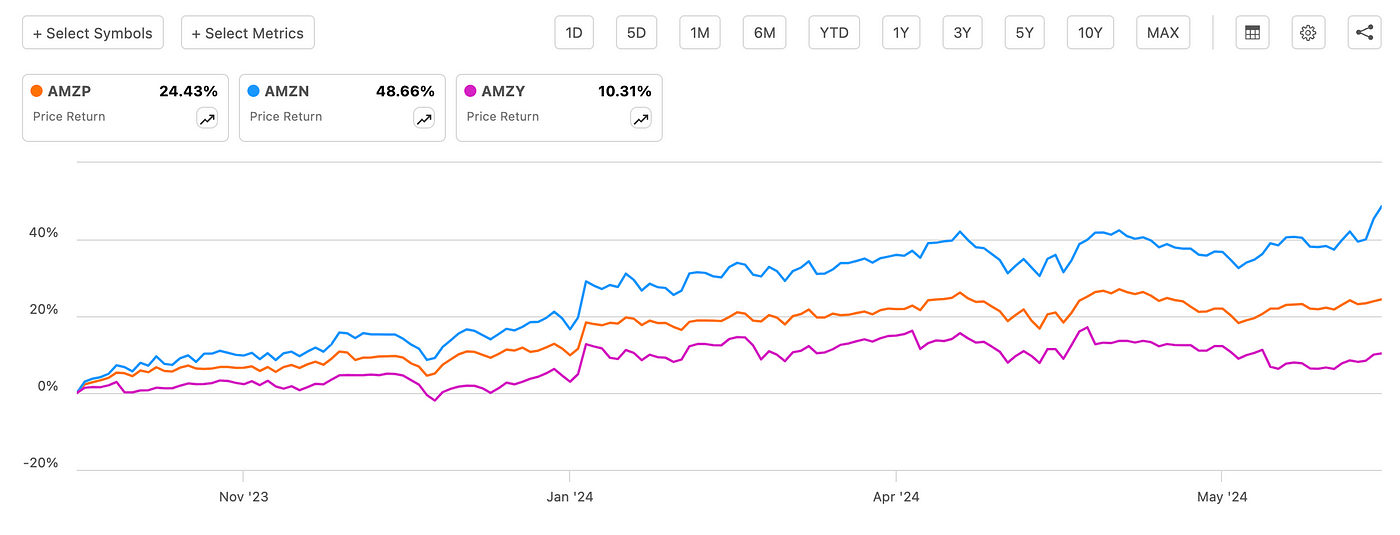

Image From Seeking Alpha | TSLP Vs. TSLY and TSLA Price Return Since October 2023 Image From Seeking Alpha | AMZP Vs. AMZN and AMZY Price Return Since October 2023

Image From Seeking Alpha | AMZP Vs. AMZN and AMZY Price Return Since October 2023 Image From Seeking Alpha | AAPY Vs. AAPL and APLY Price Return Since October 2023

Image From Seeking Alpha | AAPY Vs. AAPL and APLY Price Return Since October 2023

“So, if you’re okay with less income and would prefer a little more capital appreciation, go for the Kurv funds,” is what I would say if I didn’t dig a little deeper.

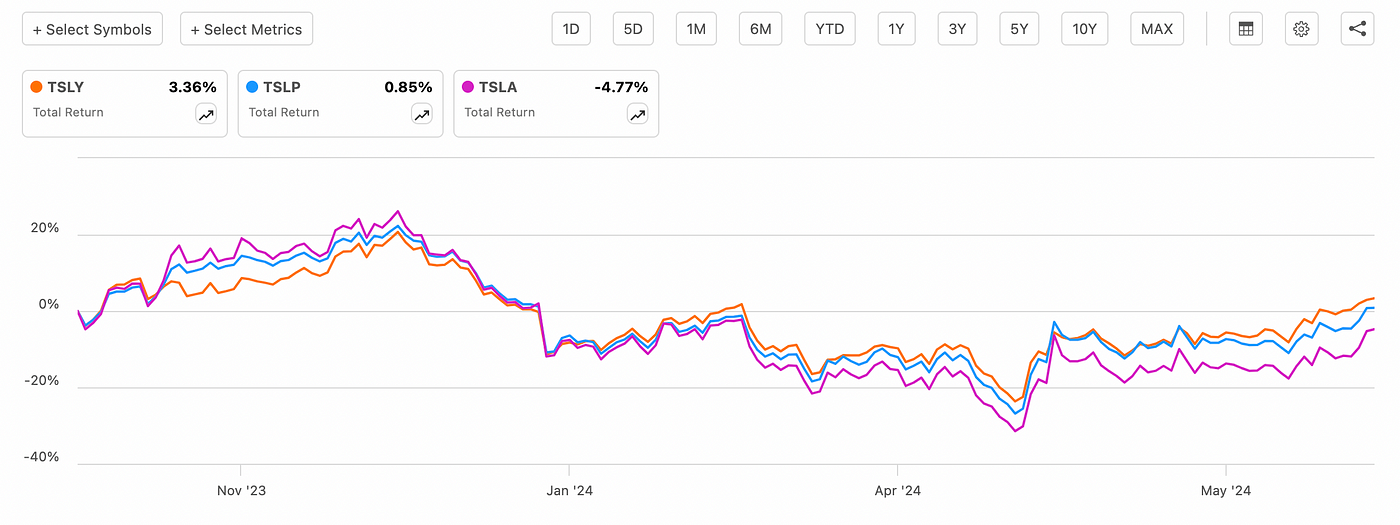

Total returns make me wonder if Kurv is worth it.

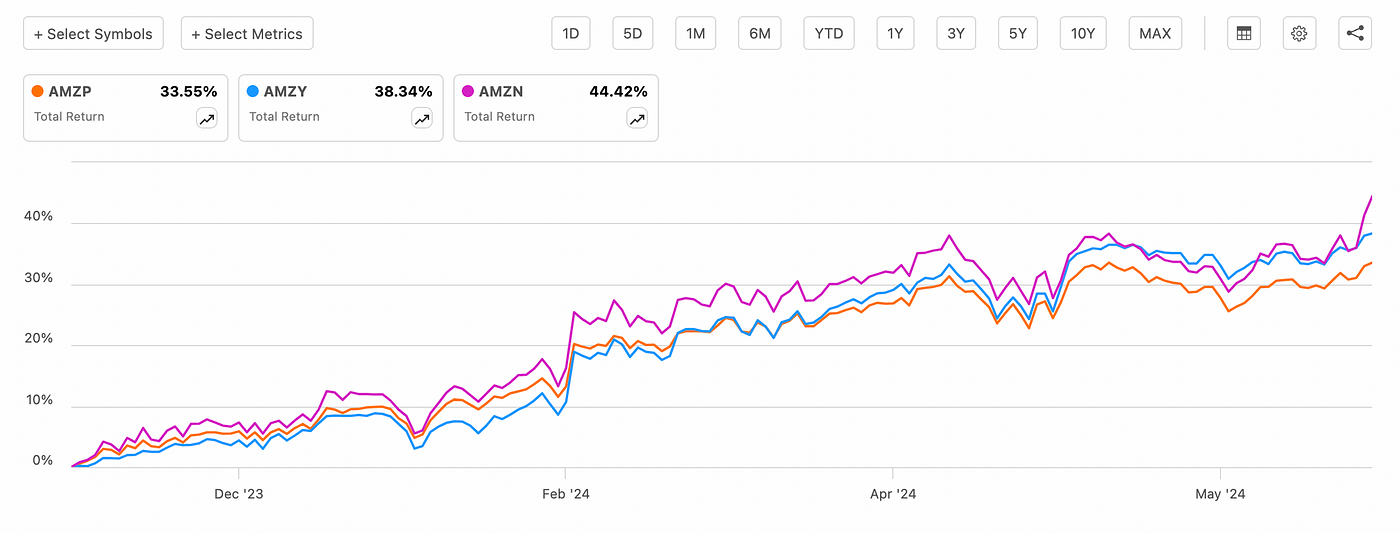

In the same three comparisons but with total return, YieldMax has beaten Kurv consistently.

Image From Seeking Alpha | TSLP Vs. TSLY and TSLA Total Return Since October 2023

Image From Seeking Alpha | TSLP Vs. TSLY and TSLA Total Return Since October 2023 Image From Seeking Alpha | AMZP Vs. AMZN and AMZY Total Return Since October 2023

Image From Seeking Alpha | AMZP Vs. AMZN and AMZY Total Return Since October 2023 Image From Seeking Alpha | AAPY Vs. AAPL and APLY Total Return Since October 2023

Image From Seeking Alpha | AAPY Vs. AAPL and APLY Total Return Since October 2023

These charts make no sense, considering Kurv is supposed to be capturing more capital appreciation.

Yes, at times, the Kurv funds have beaten YieldMax, and we could see more of that in the future, but we could also see it continue underperforming.

The problem with Kurv is that they have a larger human error risk.

Having fund managers adjust their options strategies depending on the market conditions is a double-edged sword.

If they do it well, they can mitigate the potential damage that systematically managed funds are hit by.

If they mess up, however, it could mean considerable underperformance.

Stick With YieldMax and Watch Kurv For Longer

Expense ratios will generally increase when you involve a more active management strategy.

This is the case with Kurv, which has an expense ratio of 0.99% — a relatively high expense ratio compared to other ETFs on the market.

However, when compared to YieldMax, it is a little better.

YieldMax’s gross expense ratio is also 0.99%, but other fees make certain funds more expensive. For example, TSLY is at 1.01%, and APLY is at 1.06% right now.

This is why I haven’t entirely written off Kurv. If you are bent on harvesting yield from single stocks via ETFs, then Kurv is worth watching.

See if the Kurv funds change at all. If enough evidence suggests that more active options management can lead to a better balance of capital appreciation and income, then Kurv could have a place in your income portfolio.

However, this is only if the super high yield legitimately benefits you.

For most income investors, more diversified funds like JEPI, which have lower yields but better capital appreciation, will be suitable.

You can also find more income-investing ideas here on Seeking Alpha. Always do your due diligence before investing in anything.

Want more investment coverage and analysis? Check out the list below for my complete collection of articles analyzing various stocks and ETFs!

Stock and ETF Analysis

Financial Disclaimer: The views in this article are the author’s personal views. This commentary is provided for general informational purposes only. It does not constitute financial, investment, tax, legal, or accounting advice or an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this article should consult with their advisor. The information provided in this article has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Their values change frequently, and past performance may not be repeated.

Affiliate Link Disclosure: You may assume all links in this article are affiliate links. If you purchase any product or service through the link, I may be compensated at no extra cost to you.

Visit us at DataDrivenInvestor.com

Subscribe to DDIntel here.

Join our creator ecosystem here.

DDI Official Telegram Channel: https://t.me/+tafUp6ecEys4YjQ1

Follow us on LinkedIn, Twitter, YouTube, and Facebook.

Originally published on Medium.com. Get a Medium membership and read articles like this one ad-free.

Leave a Reply