When investors like Warren Buffett advise to invest in low-cost S&P 500 index funds, it isn’t necessarily because they think fund managers are incompetent.

It’s that beating the market is already tricky, and even when you have a fund manager who beats it, it’s unlikely that you will beat the market after paying the management fees.

That’s why a crucial part of Buffett’s advice is to invest in low-cost index funds. The fewer fees you have to pay, the higher the returns.

So why did I tell this story?

Well, iShares, an ETF provider under BlackRock, recently launched IVVW, the iShares S&P 500 BuyWrite ETF, and used its size to launch a covered call fund with the lowest fees in the world.

With an expense ratio of 0.25%, it’s about ten basis points less expensive than the next cheapest covered call fund.

Do these lower fees mean IVVW should replace your other S&P 500-covered call funds?

Let’s find out.

IVVW — A S&P 500 ETF Plus 1% OTM Covered Calls

For a covered call fund, IVVW is simple.

It holds 100% of its assets in an S&P 500 ETF, which happens to be its own fund, IVV, and sells monthly 1% out-of-the-money covered calls.

An Introduction To Covered Calls And How Ultra High Yield Funds Achieve 10%+ Yields

The special thing about IVVW’s covered calls, however, is that they don’t sell call options on IVV but instead directly on the SPX.

This gives them access to European-style options that can only be exercised on expiration dates, making it easier for them to manage by rolling or cash-settling their options monthly.

Additionally, trading SPX options makes IVVW’s option premiums more tax-efficient. The options are classified as Section 1256 contracts, where gains and losses are treated as 60% long-term and 40% short-term, regardless of the holding period.

Simple Isn’t Always Better

I advocate for simplicity most of the time. However, simplicity isn’t always better, especially regarding covered calls.

We have already seen what happens when funds systematically write at-the-money monthly call options on 100% of their equity portfolio over the long term from Global X.

Here’s The Problem With Global X’s YLDs And Their 10%+ Yield

The problem with the Global X funds is that they experience long-term capital erosion due to the lack of upside protection.

XYLD is the most comparable to IVVW, and this is how the fund has performed in the past 11 years.

Image From Seeking Alpha | XYLD Vs. S&P 500 Price Return Since June 2013

Image From Seeking Alpha | XYLD Vs. S&P 500 Price Return Since June 2013

The case above shows what would happen to XYLD if you withdrew and used all your dividends. It’s not bad compared, but you are down 0.12% after 13 years.

The story is better when considering dividends and total returns.

Image From Seeking Alpha | XYLD Vs. S&P 500 Total Return Since June 2013

Image From Seeking Alpha | XYLD Vs. S&P 500 Total Return Since June 2013

It looks great until we examine some of the newer S&P 500 covered call funds.

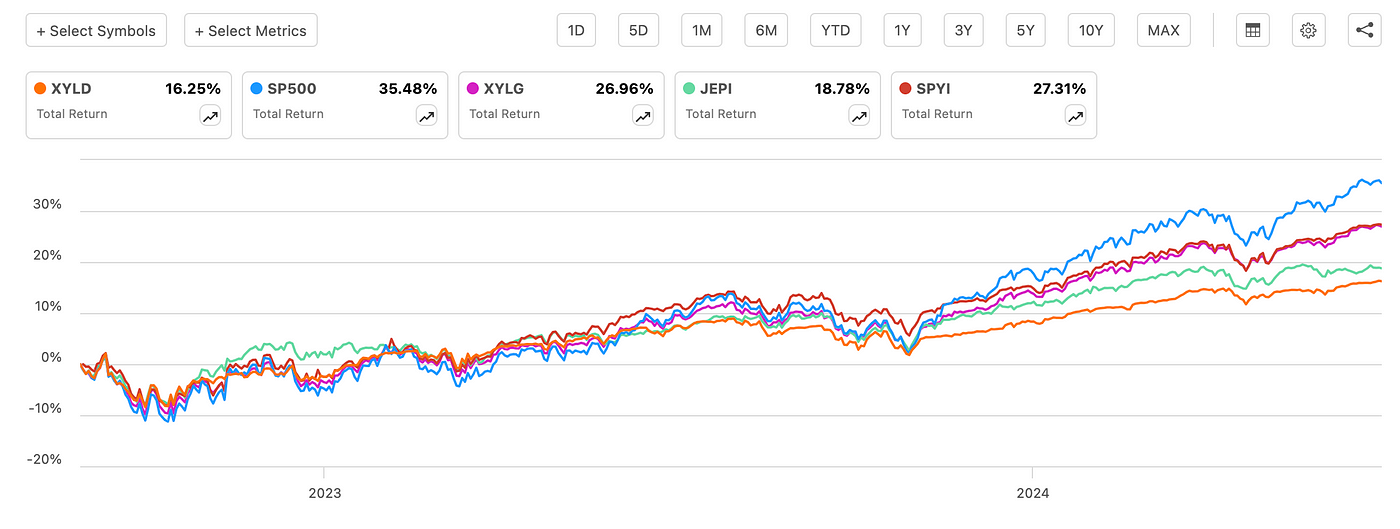

Take a look at the chart below:

Image From Seeking Alpha | XYLD Vs. S&P 500, XYLG, JEPI, and SPYI Total Returns Since August 29, 2022

Image From Seeking Alpha | XYLD Vs. S&P 500, XYLG, JEPI, and SPYI Total Returns Since August 29, 2022

XYLD has done the worst in the past two years compared to funds like XYLG, JEPI, and SPYI.

For context, XYLG is XYLD, except calls are only written on 50% of the portfolio. JEPI opts for a more defensive approach to perform better during down markets, and SPYI buys out-of-the-money call options to capture more upside if needed.

In short, “modern” covered call funds typically have strategies to capture more upside without sacrificing much yield, which has proven to provide better total returns.

In the case of IVVW, it has no strategies for capturing upside and writes calls on 100% of its portfolio, which leads me to suspect that it’ll perform similarly to XYLD over the long run.

So far, that has held true.

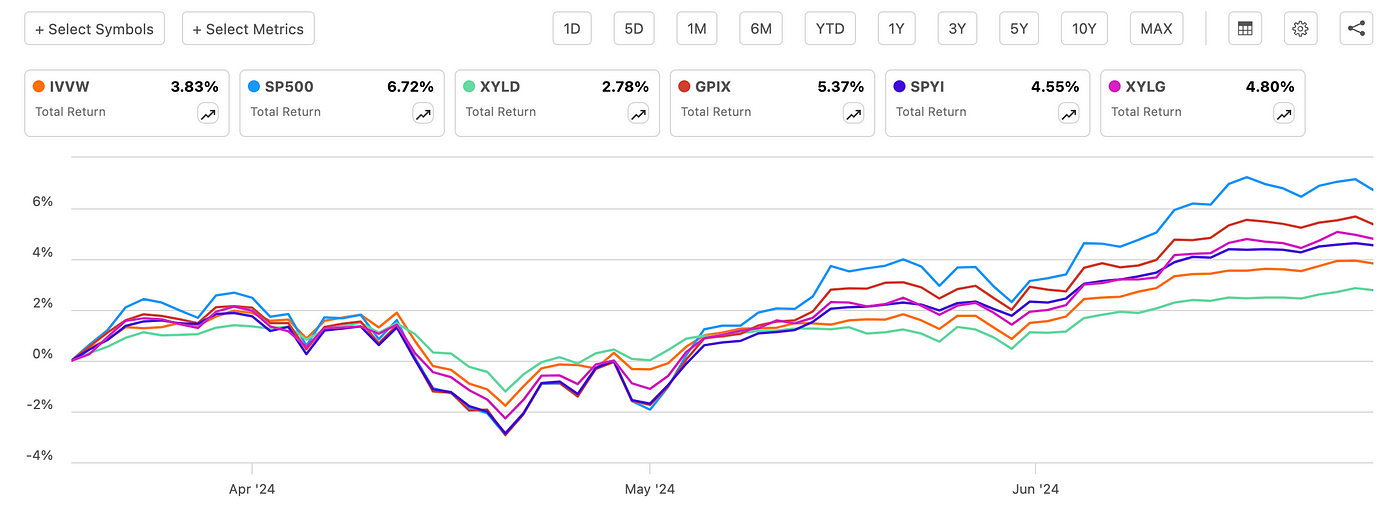

Since IVVW launched in March this year, it has underperformed most of its comparables.

Image From Seeking Alpha | IVVW Vs. S&P 500, XYLD, GPIX, SPYI, and XYLG Total Return Since March 2024

Image From Seeking Alpha | IVVW Vs. S&P 500, XYLD, GPIX, SPYI, and XYLG Total Return Since March 2024

Paying Higher Fees For Higher Returns

Yes, it’s only been three months. It’s not that much time, but given the number of comparables on the market, there isn’t a compelling reason to buy IVVW.

It does have the lowest fees for an S&P 500-covered call fund, but it’s not worth it if other funds do IVVW’s job better.

GPIX, for example, currently has an expense ratio of 0.29%, and it has outperformed IVVW by 1.54% since IVVW’s inception.

Warren Buffett has also said that he would rather buy a wonderful company at a fair price than a fair company at a wonderful price.

While this is in the context of stocks, it can be applied to income ETFs. If paying more gives you a better result, then spend more.

Don’t stop at IVVW, spend time looking at other similar funds as well. And the best place to start is this platform here.

Want more investment coverage and analysis? Check out the list below for my complete collection of articles analyzing various stocks and ETFs!

Stock and ETF Analysis

Financial Disclaimer: The views in this article are the author’s personal views. This commentary is provided for general informational purposes only. It does not constitute financial, investment, tax, legal, or accounting advice or an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this article should consult with their advisor. The information provided in this article has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Their values change frequently, and past performance may not be repeated.

Affiliate Link Disclosure: You may assume all links in this article are affiliate links. If you purchase any product or service through the link, I may be compensated at no extra cost to you.

Originally published on Medium.com. Get a Medium membership and read articles like this one ad-free.

Leave a Reply