Three days ago, I wrote an article titled “Reacting To This Redditor’s $93K Dividend Portfolio” as a mini experiment.

Reacting To This Redditor’s $93K Dividend Portfolio

My articles on stock investment portfolios have frequently garnered significant viewership, and I enjoy practicing portfolio construction using hypothetical scenarios.

At the end of January, I published an immensely popular article where I reacted to a YouTuber’s extensive, high-yielding investment portfolio titled, “This YouTuber’s $1.33M Dividend Portfolio Makes $21K Per Month.”

This YouTuber’s $1.33M Dividend Portfolio Makes $21K Per Month

The success of this article made me wonder if reacting to other people’s portfolios could be something I did more frequently which was why I published the more recent article on a Redditor’s post.

Based on current results and feedback, the answer is yes.

Hence, I’ll be spending more time diving into portfolios, analyzing them, and giving my perspective on what to do to help you pick your investments.

It’ll be like a series. There will be no logical order, but you can find all the portfolio articles in this list below:

Investment Portfolio Articles

Today, we’ll look at the popular YouTuber Dividendology, his portfolio of 30 holdings, and his stock investment methodology.

A Portfolio of 30 Dividend Growth Companies

For those who don’t know Dividendology, he’s a YouTuber who joined the platform in 2021 and has since amassed over 100k subscribers, publishing primarily content on dividend stock investing.

When he published his video on March 1st, 2024, he has a $160k portfolio projected to pay him over $5k this year.

Here are the 30 holdings in his portfolio:

- EPD — Enterprise Products Partners L.P.

- IBM — International Business Machines Corporation

- JNJ — Johnson & Johnson

- KHC — The Kraft Heinz Company

- KO — The Coca-Cola Company

- MO — Altria Group, Inc.

- MSFT — Microsoft Corporation

- O — Realty Income Corporation

- SJM — The J. M. Smucker Company

- MMM — 3M Company

- VICI — VICI Properties Inc.

- BAC — Bank of America Corporation

- DPZ — Domino’s Pizza, Inc.

- INTC — Intel Corporation

- SBUX — Starbucks Corporation

- LOW — Lowe’s Companies, Inc.

- JPM — JPMorgan Chase & Co.

- JEPI — JPMorgan Equity Premium Income ETF

- TGT — Target Corporation

- V — Visa Inc.

- TXN — Texas Instruments Incorporated

- CAT — Caterpillar Inc.

- TROW — T. Rowe Price Group, Inc.

- CSCO — Cisco Systems, Inc.

- AVGO — Broadcom Inc.

- JEF — Jefferies Financial Group Inc.

- SCHD — Schwab U.S. Dividend Equity ETF™

- AAPL — Apple Inc.

- WM — Waste Management, Inc.

- LVMHF — LVMH Moët Hennessy — Louis Vuitton, Société Européenne

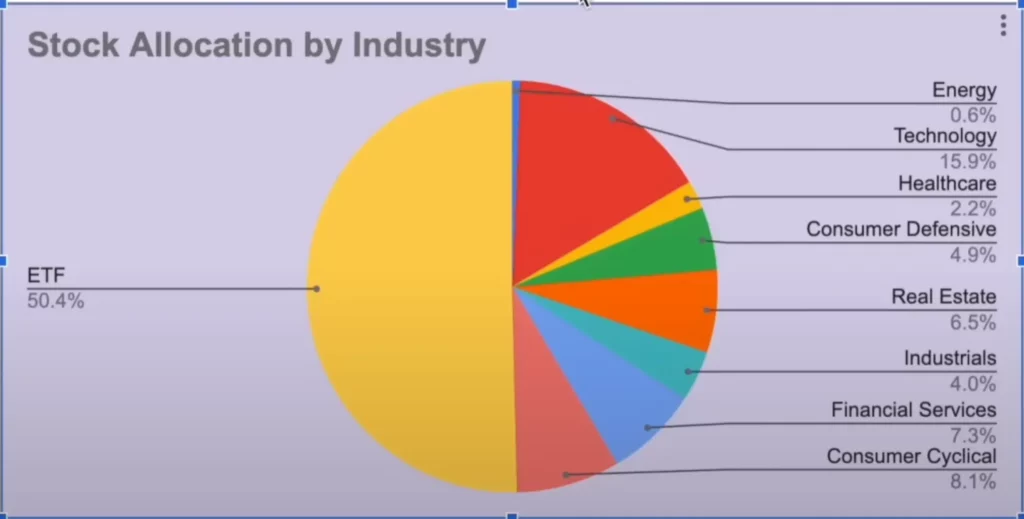

And here’s Dividendology’s sector allocation:

Investing In Dividend Growth Stocks

Now, I’m not going to break down each individual holding like I have done in the past because, quite frankly, I don’t know enough about many of his holdings.

What I am going to do, however, is discuss Dividendology’s investment strategies and philosophies.

Dividendology’s investment philosophy can be summed to investing for dividend growth.

His strategy revolves around looking for investments that have consistently increased their free cash flow and have a history of continuously growing dividend payouts.

This investing strategy has allowed him to amass a $32,523.14 gain (realized and dividends included) for a 23.68% return.

Personally, I love this strategy and use it myself with minor differences.

The idea is to buy into companies with sound economic fundamentals, and you will eventually be able to live off your dividends over the long term.

Yes, you will sacrifice what you could get in the short term.

Many of Dividendology’s holdings only yield 2–3%, which is why his $160k portfolio only pays him $5k in a year. There are investments out there that could pay him $32k per year on his $160k portfolio if he wanted.

Unfortunately, these high-yielding investments can not sustain their dividend payments over the long term. They may sustain their yield at the cost of their capital, but that’s not what we want.

The goal is to have a $640k portfolio paying $20k per year after ten years — not a $40k portfolio paying $8k.

What Most Dividend Investors Should Do

Dividendology’s investing strategy is what most dividend investors should do. Spend time looking for companies that have improved their free cash flow and pick out the ones that have consistently grown their dividend payments.

Ultimately, you want a sizable portfolio with a large yield on cost.

Want more investment news and analysis? Seeking Alpha is my first stop for all my research. Take a look at the Seeking Alpha platform here.

Financial Disclaimer: The views in this article are the author’s personal views. This commentary is provided for general informational purposes only. It does not constitute financial, investment, tax, legal, or accounting advice, nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this article should consult with their advisor. The information provided in this article has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Their values change frequently, and past performance may not be repeated.

Affiliate Link Disclosure: You may assume all links in this article are affiliate links. If you purchase any product or service through the link, I may be compensated at no extra cost to you.

Visit us at DataDrivenInvestor.com

Subscribe to DDIntel here.

Have a unique story to share? Submit to DDIntel here.

Join our creator ecosystem here.

DDIntel captures the more notable pieces from our main site and our popular DDI Medium publication. Check us out for more insightful work from our community.

DDI Official Telegram Channel: https://t.me/+tafUp6ecEys4YjQ1

Follow us on LinkedIn, Twitter, YouTube, and Facebook.

Originally published on Medium.com. Get a Medium membership and read articles like this one ad-free.

Leave a Reply