One of the hottest investment products in the new decade has been actively managed income funds.

Many new ETFs have been launched in the last few years that employ an options strategy to generate ultra-high yields, often exceeding 10%.

The most popular strategy has been selling covered calls, which have been applied to nearly every asset class imaginable.

An Introduction To Covered Calls And How Ultra High Yield Funds Achieve 10%+ Yields

It started with stocks, then bonds, then gold, and now, we have bitcoin as well.

Today, we’ll discuss YBTC—the Roundhill Bitcoin Covered Call Strategy ETF. This is a covered call bitcoin fund launched this year, and its current yield is 50.35%.

How YBTC Writes Covered Calls On Bitcoin

According to Roundhill’s website, “The Roundhill Bitcoin Covered Call Strategy ETF (“YBTC”) is the first U.S.-listed bitcoin covered call ETF. The Fund offers exposure to bitcoin*, subject to a cap, while providing the potential for high current income. YBTC is an actively managed ETF.”

If you look around on Roundhill’s website, you’ll notice that “exposure to Bitcoin” is often accompanied by an asterisk and a disclaimer that says:

“The fund does not invest in bitcoin directly; it seeks to provide exposure to the price return of an exchange-traded fund that invests principally in bitcoin futures contracts (the “Bitcoin Futures ETF”).”

Since funds can’t write covered calls directly on Bitcoin, YBTC uses an interesting strategy of selling covered calls on BITO — the ProShares Bitcoin Strategy ETF.

BITO is a fund that works to replicate the price movements of bitcoin without holding the cryptocurrency directly. They do this through trading bitcoin futures.

BITO: How to Get a 13.07% Yield Out of Bitcoin

So far, BITO has tracked bitcoin’s price accurately, which means BITO has high implied volatility (IV) due to bitcoin’s large price swings.

This is why YBTC’s yield is so high. Selling covered calls on higher IV assets will generate more significant option premiums as the risk of missing out on large gains is bigger.

It is also worth noting that YBTC doesn’t hold BITO directly but implements a synthetic covered call strategy, similar to what YieldMax does with funds such as TSLY.

By simultaneously buying a call option and selling a put option on BITO with the same expiration date and strike price, YBTC can create the effect of holding actual shares of BITO.

Then, they sell a call option to generate the premiums. This strategy requires one to use leverage, which is why YBTC’s holdings consist primarily of U.S. treasuries.

YBTC — Not Bad, But Just Make Sure It Makes Sense

Overall, YBTC’s strategy is not significantly flawed and it does work.

That being said, you need to ensure that what you’re getting from YBTC is what you want.

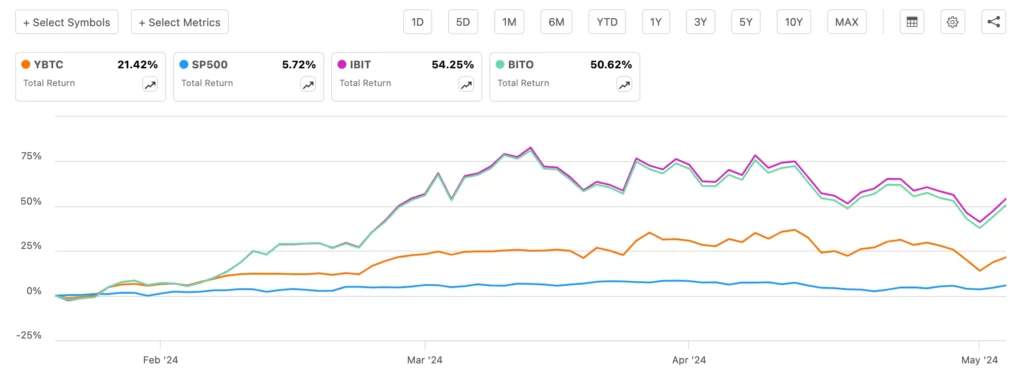

Take a look at the chart below:

When bitcoin rises, YBTC will significantly underperform the asset, as covered calls cap your upside.

Don’t forget that the distributions are taxed if not held in a tax-advantaged account and the fund’s 0.95% management fee.

You will almost always have a larger portfolio by buying and holding the growth asset over selling covered calls.

Those seeking income over total return must understand that YBTC pays highly variable and unpredictable dividends.

Since its inception, YBTC’s yields have ranged from 33% to over 100%, with dividend payments fluctuating between $1.33 to $4.13.

It’s only been four months, too.

With this in mind, YBTC should not be a core holding in any portfolio. It is best used with other high-yielding investments in different asset classes for income.

Want more investment coverage and analysis? Check out the list below for my complete collection of articles analyzing various stocks and ETFs!

Stock and ETF Analysis

For those seeking more info on the stock market and investing, Seeking Alpha is my first stop for all my research. Take a look at the Seeking Alpha platform here.

Financial Disclaimer: The views in this article are the author’s personal views. This commentary is provided for general informational purposes only. It does not constitute financial, investment, tax, legal, or accounting advice, nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this article should consult with their advisor. The information provided in this article has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Their values change frequently, and past performance may not be repeated.

Affiliate Link Disclosure: You may assume all links in this article are affiliate links. If you purchase any product or service through the link, I may be compensated at no extra cost to you.

Visit us at DataDrivenInvestor.com

Subscribe to DDIntel here.

Featured Article:

Singapore: Unveiling a Tapestry of Possibilities and Global Connections

Introducing Singapore’s Fund Platform | Accelerating Fund’s Setup, Launch, and Operational Efficiency

Join our creator ecosystem here.

DDI Official Telegram Channel: https://t.me/+tafUp6ecEys4YjQ1

Follow us on LinkedIn, Twitter, YouTube, and Facebook.

Originally published on Medium.com. Get a Medium membership and read articles like this one ad-free.

Leave a Reply