One of my most viewed articles published in the last few days on Seeking Alpha was one about the Roundhill Innovation-100 0DTE Covered Call Strategy ETF (QDTE) for a pretty good reason.

Since its inception in March, QDTE has beaten its underlying index—the NASDAQ 100—in total returns while offering 20%+ yielding weekly distributions.

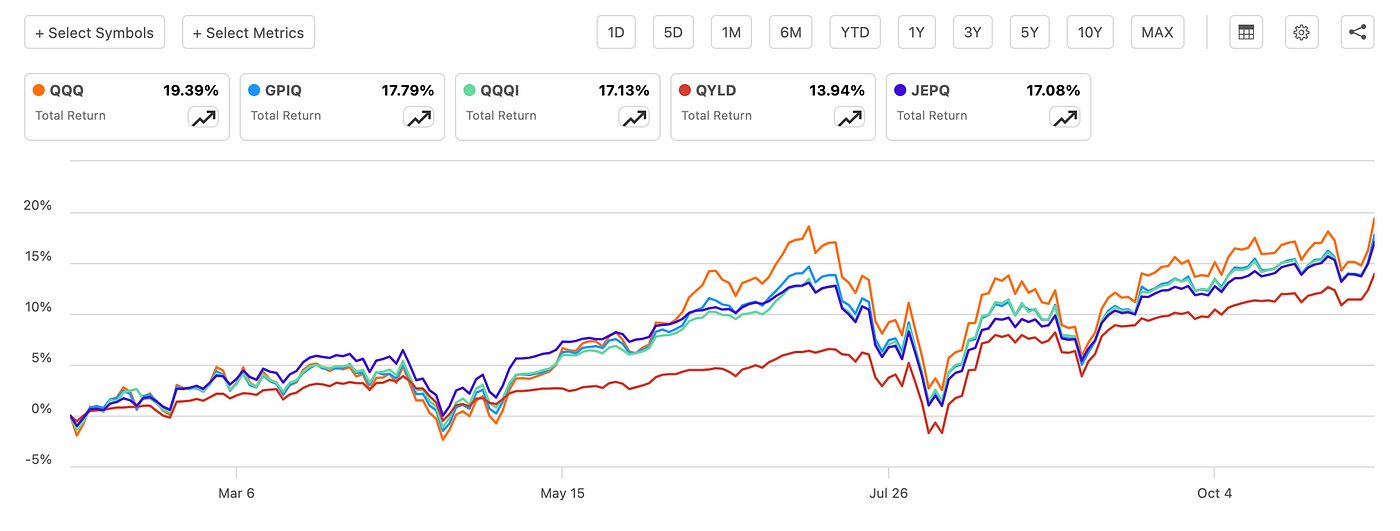

Image From Seeking Alpha | QDTE Vs. QQQ Total Returns Since 3/7/2024

Image From Seeking Alpha | QDTE Vs. QQQ Total Returns Since 3/7/2024

You’ll also notice that QDTE has beaten QQQ in a generally rising market. Aside from the period in June, the fund has done a surprisingly good job of capturing the upside in the underlying.

This kind of performance from a covered call fund is unprecedented.

Typically, covered call funds will underperform the index when the market is trending upwards. Just take a look at how other NASDAQ 100 covered call funds have performed compared to QQQ:

Image From Seeking Alpha | QQQ Vs. GPIQ, QQQI, QYLD, and JEPQ Total Returns Since 1/30/2024

Image From Seeking Alpha | QQQ Vs. GPIQ, QQQI, QYLD, and JEPQ Total Returns Since 1/30/2024

With data constrained to January 30, 2024 (the inception date of QQQI), some of the most popular NASDAQ 100 covered call ETFs have all underperformed QQQ even after considering how many of them, such as GPIQ, QQQI, and JEPQ, use strategies like selling covered calls on a smaller portion of the portfolio or selling them out-of-the-money (OTM) to capture more upside.

Hence, to see a covered call fund like QDTE outperform the NASDAQ 100 during a rising market has attracted many investors and helped the fund garner over half a billion dollars in AUM in just eight months.

0DTE Options Plus Superb Active Management = $$$

QDTE has outperformed other NASDAQ 100 covered call funds mainly because it sells 0 days-to-expiry (0DTE) call options.

There’s been a misconception that 0DTE options are more risky, likely stemming from the performances of Defiance funds, such as QQQY and IWMY, which have suffered significant NAV erosion since their inception.

However, 0DTE options are generally less risky regarding sustainably and consistently generating income because they have a higher win percentage.

In my study, I found that selling calls at 1% OTM on the NASDAQ 100 daily had a win percentage of approximately 78% versus the 40% on monthly.

Yes, the premium will also be smaller from selling daily calls, but the theory is to consistently generate small profits rather than taking 50/50 chances at large ones.

And this theory has proven itself so far, with multiple daily covered call funds outperforming their monthly counterpart.

Additionally, having active management has helped bolster QDTE’s returns as well. Instead of selling calls at fixed moneyness daily, the management team will adjust based on the market conditions.

You are paying a 0.95% expense for this, but given that returns already factor in the management fee, QDTE has so far shown that the cost is worth it.

Declining NAV and the Fix

Of course, QDTE’s performance has not been all sunshine and rainbows. One of the most significant risks of all high-yielding ETFs is NAV erosion.

After all, what’s the point of high yields if your original capital and distribution amounts are declining over time?

And with QDTE, there has been some NAV erosion. Since its inception, QDTE has been down about 6%, while QQQ has been up over 15%.

Image From Seeking Alpha | QDTE Vs. QQQ Price Return Since 3/7/2024

Image From Seeking Alpha | QDTE Vs. QQQ Price Return Since 3/7/2024

But fortunately for QDTE, there is some good news.

Just like how we wouldn’t evaluate an ETF only looking at yields, dismissing an ETF as soon as you see NAV erosion isn’t always the right decision.

NAV erosion is important because many income investors will not reinvest all their dividends. When you depend on your dividends for your income, you want to be confident that your original principal and future earnings are not falling over time.

But realistically, do income investors really need a 25% yield?

If you bought QDTE at inception and reinvested half of your dividends, you would have had a phenomenal balance of capital appreciation and income.

An initial portfolio value of $99,985.32 would have dropped to $99,597.41 (higher now because stocks just shot up), but you would have captured payouts on track to yield 18%.

Essentially, if you reinvested half of your dividends from QDTE, you would technically have an investment that retained most of its value with less volatility while still getting 18% in distributions.

You can get a closer look at this strategy in my article on Seeking Alpha.

The beauty of these income investments is that these strategies are entirely flexible. If you don’t need the income, reinvest more. If you need more income, reinvest less.

Now, the biggest concern with this type of strategy is the ability of a fund to hold its AUM. If the fund is very small, unable to attract investor interest, and quickly loses its NAV, it doesn’t matter if you reinvest because it will eventually become insolvent.

However, with QDTE, things have looked good so far. It has over $500M AUM, which continues to grow.

It is a buy in my books, but like any other investment, past performance does not necessarily indicate future performance, and one should always do their own due diligence before investing.

An excellent place to start would be Seeking Alpha. This platform allows you to find different perspectives from numerous analysts on various stock market investments, which will help you better understand whether certain investments are right for you.

You can take a look at Seeking Alpha here.

Want more investment coverage and analysis? Check out the list below for my complete collection of articles analyzing various stocks and ETFs!

Stock and ETF Analysis

Financial Disclaimer: The views in this article are the author’s personal views. This commentary is provided for general informational purposes only. It does not constitute financial, investment, tax, legal, or accounting advice or an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this article should consult with their advisor. The information provided in this article has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Their values change frequently, and past performance may not be repeated.

Affiliate Link Disclosure: You may assume all links in this article are affiliate links. If you purchase any product or service through the link, I may be compensated at no extra cost to you.

Originally published on Medium.com. Get a Medium membership and read articles like this one ad-free.

Leave a Reply