Covered call funds have become extremely popular this decade, with numerous companies launching high-yield, monthly (and sometimes even weekly) paying ETFs.

One of the most popular strategies companies have adopted is selling covered calls on indices like the S&P 500 and NASDAQ 100, but every company has its own twists.

Each time a new fund comes out, investors are confused about whether they should switch their money to it, as each company presents its strategy as the best.

As a writer who covers these investments, I frequently get asked how certain investments compare to others and which ones are the best.

It’s a difficult question, as everyone’s situation is different, but I hope I can help narrow down the answers with articles like the one you’re reading right now.

Today, I’m going to share my top five high-yield S&P 500 buy-write ETFs:

- NEOS S&P 500 High Income ETF (SPYI)

- JPMorgan Equity Premium Income ETF (JEPI)

- Roundhill S&P 500 0DTE Covered Call Strategy ETF (XDTE)

- Goldman Sachs S&P 500 Core Premium Income ETF (GPIX)

- ProShares S&P 500 High Income ETF (ISPY)

Keep in mind that these are my personal favorites, and it is advised that you do further research to determine whether they work for you.

5. SPYI — 12% Target Distributions

At my number five spot, I have SPYI from NEOS. This fund launched in 2022 and has since amassed over $2.11B in AUM deservedly.

What SPYI promised compared to the typical covered call ETF was the ability to protect capital appreciation while providing large distributions through a more active management strategy.

Instead of writing static covered calls monthly, SPYI writes dynamic out-of-the-money (OTM) calls and targets a 12% yearly distribution rate. They also can sell credit spreads if needed.

This added flexibility allows SPYI to be more conservative or aggressive depending on market conditions, allowing it to maintain more capital appreciation.

The one caveat, however, is that SPYI’s target distribution rate may be too aggressive. It has sacrificed overall total returns in return for higher distributions compared to some other funds.

You can learn more in a full SPYI analysis I wrote on Seeking Alpha here.

Some SPYI Stats

- Dividend Yield: 11.63%

- Expense Ratio: 0.68%

- AUM: $2.11B

- YTD Total Return: 17.48%

- Inception Date: 8/30/2022

4. JEPI — Best For Lower Volatility

Coming in at number four, we have JEPI. It is by far the most popular ETF on this list, with over $36.57B in AUM. Yes, that’s nearly 18 times that of SPYI.

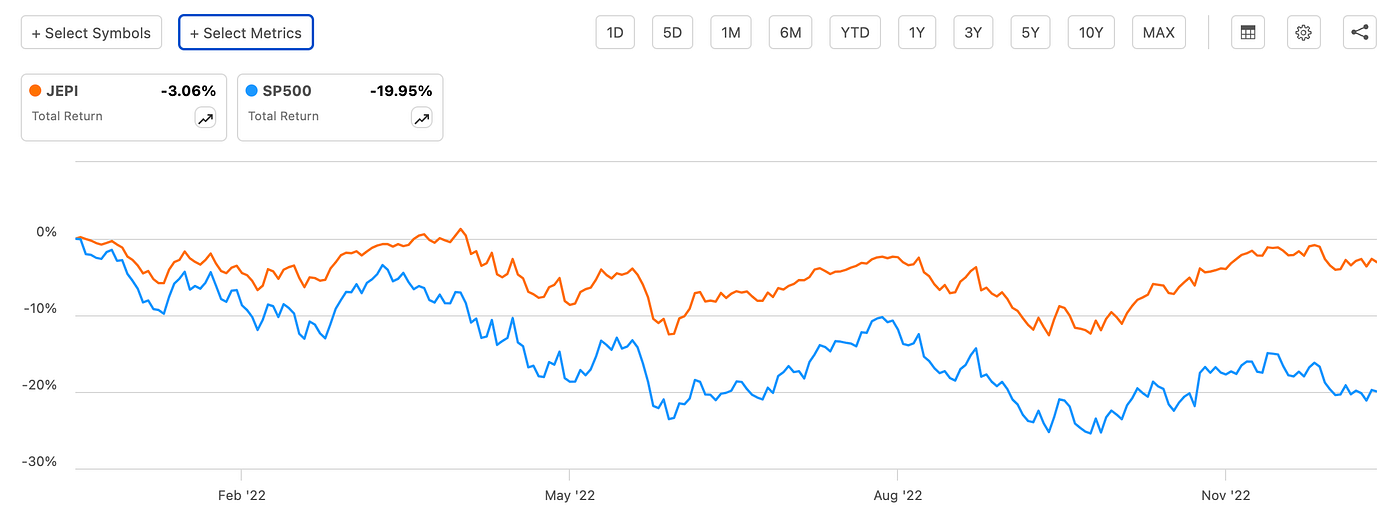

JEPI is popular because it has proven to perform well during bear markets. During the 2022 bear market, for example, JEPI was only down approximately 3% in total returns compared to the S&P 500’s almost 20%.

Image From Seeking Alpha

Image From Seeking Alpha

With lower volatility than the S&P 500 and yields between 7% and 12%, depending on the market condition, this ETF is a retiree’s dream.

What JEPI does differently from other S&P 500 covered call funds is that it doesn’t actually track the S&P 500. Its portfolio consists of stocks selected by JPMorgan and are weighted more equally, so the fund isn’t significantly affected by one company or sector’s downturn.

Although yields may be low right now, at 7.08%, they generally go up as market volatility increases.

Some JEPI Stats

- Dividend Yield: 7.08%

- Expense Ratio: 0.35%

- AUM: $36.57B

- YTD Total Return: 14.19%

- Inception Date: 5/20/2020

3. XDTE — Highest Yield and Strong Total Returns?

Now, to mix things up, we have a little more of an unproven winner in XDTE. This fund was only launched in March this year, but it has been outperforming the S&P 500 so far.

Covered calls are traditionally known for their tendency to underperform their underlying asset when they rise as option strike prices cap upsides.

So, hearing that a covered call fund outperforms the S&P 500 when it’s up immediately turns heads.

The difference between XDTE and many other covered call funds is that it sells daily call options instead of monthly. This allows XDTE to capture the upside of the S&P 500 much better because selling daily calls on the S&P 500 is a higher-percentage winning play than monthly.

Additionally, XDTE turns heads because it distributes income weekly and currently yields 18.54%. It’s an adventurous investment, but definitely worth looking into.

Here’s my full breakdown of XDTE on Seeking Alpha.

Some XDTE Stats

- Dividend Yield: 18.54%

- Expense Ratio: 0.95%

- AUM: $185.10M

- YTD Total Return: 14.10% (limited to March 7, 2024)

- Inception Date: 3/7/2024

2. GPIX — Well-Balanced and Conservative Strategy

One of the things I learned while studying all these covered call ETFs is that selling calls at-the-money (ATM) on smaller portions of the portfolio could capture more upside than selling OTM calls on bigger portions of the portfolio.

This is what we see with GPIX and why I have it at my number two spot.

Like SPYI, GPIX also targets a yield, although the number is far more conservative at 8.5%.

However, the lower yield’s benefit is much stronger capital appreciation and higher total returns overall. Since its inception, GPIX has outperformed SPYI by nearly 8%.

An 8.5% yield is by no means low, either. For many people, this is more than acceptable.

You can read my full analysis of GPIX on Seeking Alpha here.

Some GPIX Stats

- Dividend Yield: 8.02%

- Expense Ratio: 0.29% (0.06% Waived For Now)

- AUM: $244.67M

- YTD Total Return: 19.40%

- Inception Date: 10/24/2023

Honorable Mentions — XYLD, SPYT

Before I reveal my number one S&P 500 covered call ETF, I want to discuss a few honorable mentions. Two ETFs that did not ultimately make this list are the Global X S&P 500 Covered Call ETF (XYLD) and the Defiance S&P 500 Target Income ETF (SPYT).

We can talk about XYLD a little first.

XYLD — Longest History

XYLD is interesting because it has years of history. We have 10 years of data to see how XYLD fares in different markets.

And its performance is not bad, but better options exist nowadays.

You’ll see that XYLD consistently outperforms the S&P 500 during downturns on par or better than JEPI. However, it caps growth drastically and isn’t the best option for long-term investors willing to ride out the market’s ups and downs.

SPYT — High Yield But Risky

Another ETF many people are interested in right now is SPYT. This ETF is similar to XDTE, with one key difference being its target yield of 20%.

While its performance so far has been decent, the target is much too high, and SPYT will have to sacrifice some capital in return for higher distributions.

However, this could be an interesting option for those super interested in high yield.

1. ISPY — The Best Overall

With honorable mentions out of the way, let’s talk about the number one best overall S&P 500 covered call ETF. After spending days researching these ETFs, I’ve found ISPY to become my favorite.

It has the best balance of capital appreciation and income because it uses daily call options more conservatively than XDTE and SPYT.

Instead of targeting super high double-digit yields, ISPY is more conservative with their calls by placing them further OTM and not using leverage.

The result is a fund that still yields a respectable 9.13% while maintaining prospects for capital appreciation.

You can find my full analysis of ISPY on Seeking Alpha here.

Some ISPY Stats

- Dividend Yield: 9.13%

- Expense Ratio: 0.55%

- AUM: $297.62M

- YTD Total Return: 20.58%

- Inception Date: 12/18/2023

I hope you found this list of my top five S&P 500 covered call ETFs helpful. Again, this is a top five list subject to my own opinion and research. It is advised that you do your own due diligence before investing in any of these funds.

If you have any questions, please feel free to leave them in the comments below. I’m always happy to help!

Want more investment coverage and analysis? Check out the list below for my complete collection of articles analyzing various stocks and ETFs!

Financial Disclaimer: The views in this article are the author’s personal views. This commentary is provided for general informational purposes only. It does not constitute financial, investment, tax, legal, or accounting advice or an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this article should consult with their advisor. The information provided in this article has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Their values change frequently, and past performance may not be repeated.

Affiliate Link Disclosure: You may assume all links in this article are affiliate links. If you purchase any product or service through the link, I may be compensated at no extra cost to you.

Originally published on Medium.com. Get a Medium membership and read articles like this one ad-free.

Leave a Reply