In this decade, options funds have become extremely popular. It started with covered calls on index ETFs like the S&P 500. Then we got covered calls on individual stocks and all sorts of assets, including Bitcoin, bonds, and other commodities.

This doesn’t include all the innovations in the strategies we have been using with covered calls and options, either.

We started with simple, monthly at-the-money (ATM) covered calls. Then we started getting call spreads, put spreads, and everything in between.

Now, in 2024, the newest in the option ETF world is 0 days-to-expiry (0DTE) options, with companies like Roundhill and Defiance leading the charge.

We also now have ETFs that distribute payments weekly, a trend that originated from Roundhill’s QDTE and XDTE and convinced YieldMax to follow suit soon.

With all of these options ETFs, and a trend where yields seem to continue going higher and higher, investors must have the skill to discern the better from the worse to find the best investments for them.

Today, we will look at Roundhill’s S&P 500® 0DTE Covered Call Strategy ETF (XDTE) and discuss why you should look beyond NAV decay.

Things To Evaluate When Looking At High Yields

I once had someone comment on an ETF review I wrote that any yield above 10% is unsustainable.

After studying many ETFs, however, I found that that wasn’t exactly the case.

Various strategies can sustainably squeeze out 10%+ yields over many years. The more essential metrics are how much the fund drops on distribution dates and total returns.

A fund’s NAV will inevitably drop as it pays dividends and distributions on every ex-dividend date.

A good indicator that a fund is making unsustainable distributions is seeing a constant downward trend where the fund cannot regenerate its NAV above its original drop.

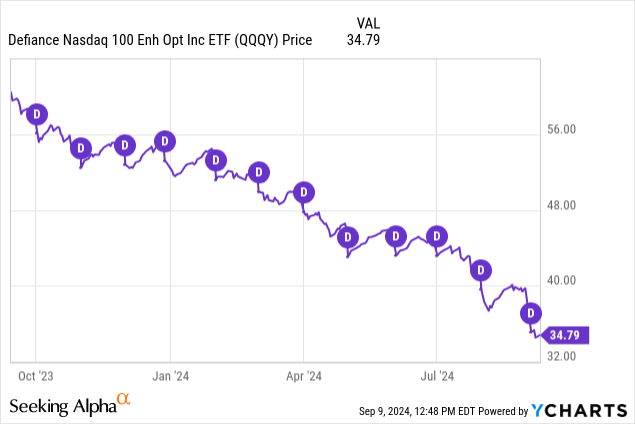

The Defiance Nasdaq 100 Enhanced Options Income ETF (QQQY) is a good example of a fund with significant NAV decay.

Image From Seeking Alpha | QQQY Price Returns With Distributions Highlighted

Image From Seeking Alpha | QQQY Price Returns With Distributions Highlighted

What you’ll notice with QQQY is that its price returns and NAV consistently trend downwards after every distribution. More often than not, it’s unable to recover its gains to above where it originally started from its options strategy.

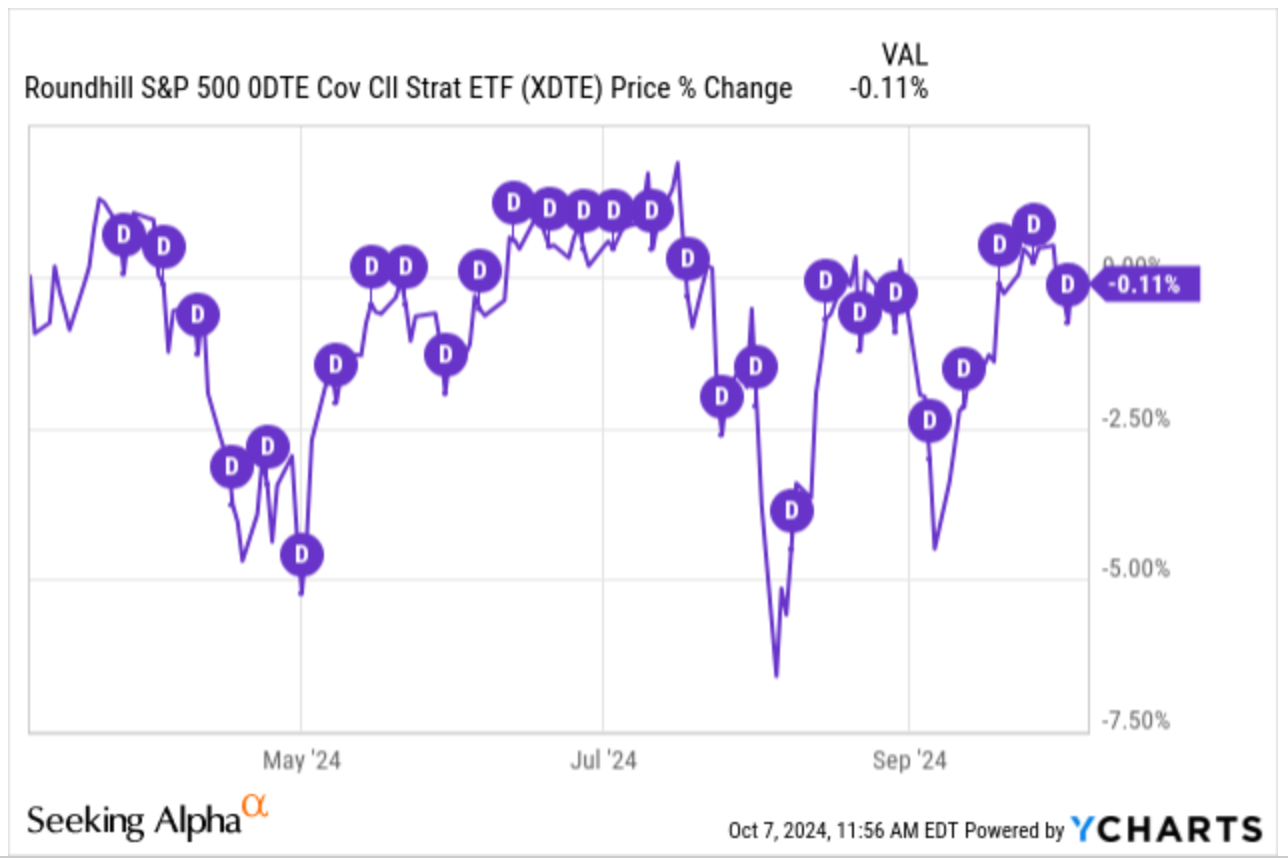

Let’s take a look at XDTE now.

Image From Seeking Alpha | XDTE Price Returns With Distributions Highlighted

Image From Seeking Alpha | XDTE Price Returns With Distributions Highlighted

Here, you can see that the dividend points are everywhere. If you try to place a line of best fit, you’ll find that the line is relatively flat.

This is especially surprising for a fund like XDTE that distributes income weekly and currently yields 18.54%.

The Power of Reinvesting Dividends

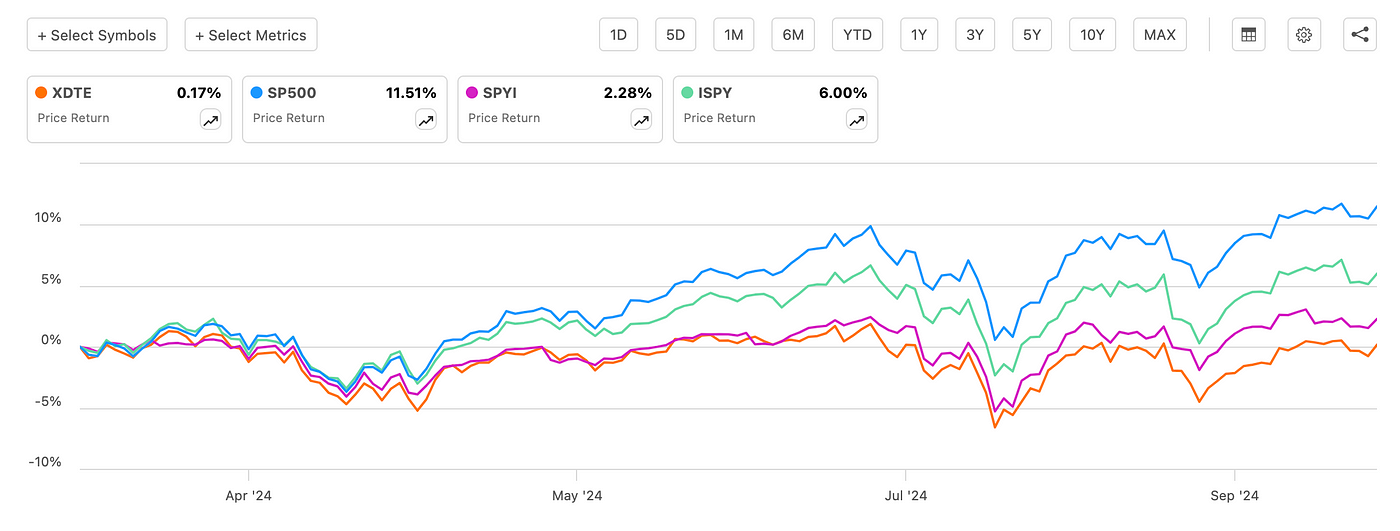

Additionally, many people glance at various high-yielding investments and instantly look away, seeing that other investments beat them from a price return standpoint.

Take a look at the following chart, for example.

Image From Seeking Alpha | S&P 500 Vs. XDTE, SPYI, and ISPY Price Return

Image From Seeking Alpha | S&P 500 Vs. XDTE, SPYI, and ISPY Price Return

It’s easy to compare price returns and immediately conclude that a fund is not worth investing in when it shows smaller price gains than comparables.

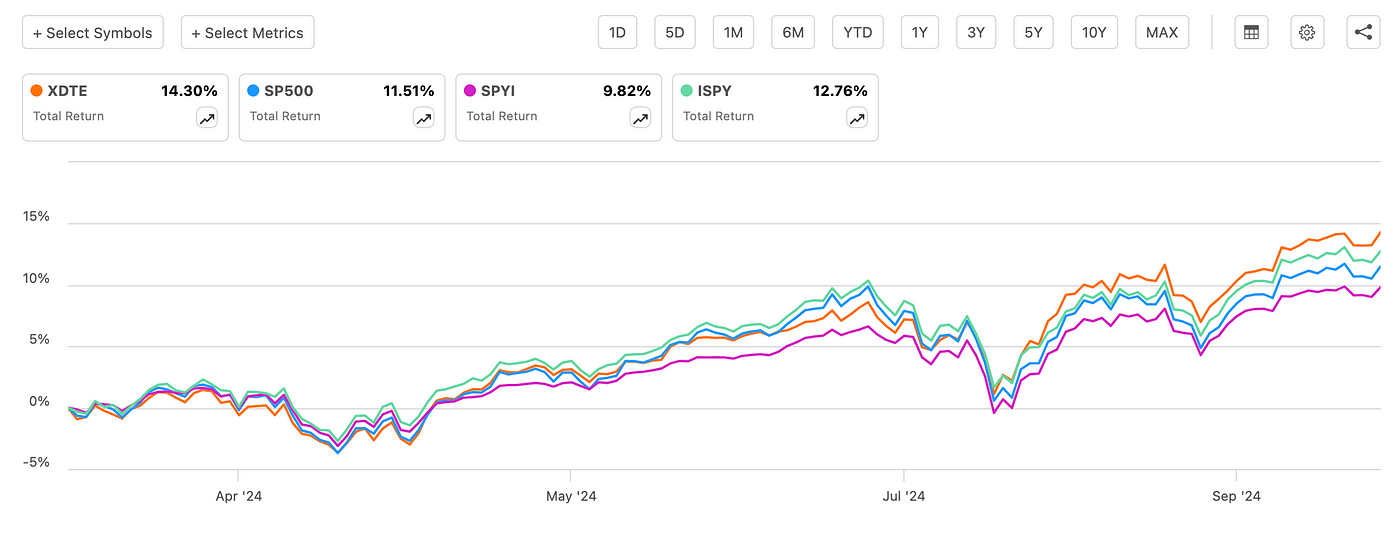

Image From Seeking Alpha | S&P 500 Vs. XDTE, SPYI, and ISPY Total Return

Image From Seeking Alpha | S&P 500 Vs. XDTE, SPYI, and ISPY Total Return

Since its inception in March this year, XDTE has actually outperformed its underlying index, the S&P 500. This is extremely surprising, considering these covered call funds generally cap their upside in exchange for income.

In the case that you do come across a fund where you see significant dividend yields and zero or even slightly depreciating prices, there are options as well.

It’s not necessarily the case that you need the complete double-digit yields every month. You can reinvest a portion of your distribution to preserve your capital.

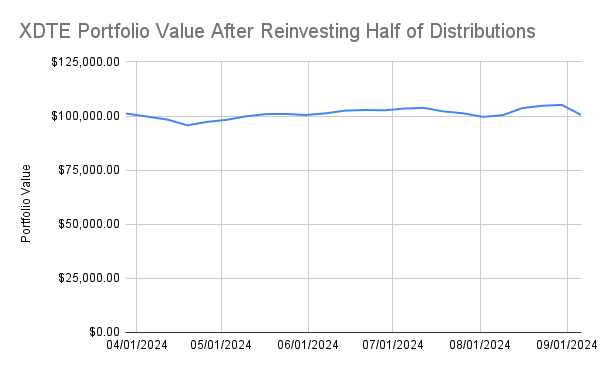

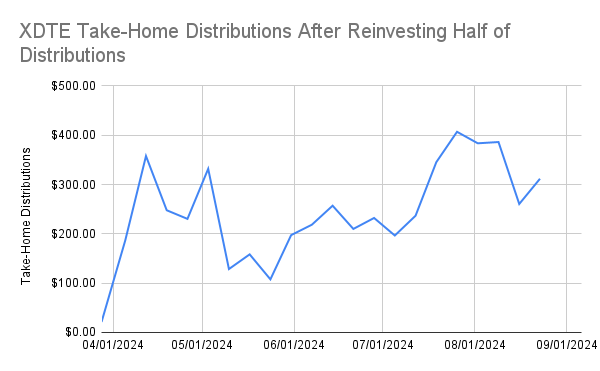

I did a study on this with XDTE in September.

At the time, XDTE was down 2.6%. By investing half of your distributions, however, your portfolio value generally remained unchanged over the last few months while generating a 12% yield.

It was almost like buying treasuries that yielded 12%.

Image From Seeking Alpha

Image From Seeking Alpha Image From Seeking Alpha

Image From Seeking Alpha

Why XDTE Is One of My Favorite Income Investments Currently

Outperforming the S&P 500 since its inception as a covered call fund is no small feat, and why XDTE is quickly becoming one of my favorite income investments.

Of course, the fund is still very new and does not have a history showing how it has performed over a long time. Hence, there are risks with this fund.

Although NAV decay and total returns are good indicators of a fund’s performance, they are not the whole story. You need to do further research and understand how the fund works.

In the article linked here, I explain how XDTE operates in more detail. It is a good starting point for further research on this Roundhill fund.

Want more investment coverage and analysis? Check out the list below for my complete collection of articles analyzing various stocks and ETFs!

Stock and ETF Analysis

Financial Disclaimer: The views in this article are the author’s personal views. This commentary is provided for general informational purposes only. It does not constitute financial, investment, tax, legal, or accounting advice or an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this article should consult with their advisor. The information provided in this article has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Their values change frequently, and past performance may not be repeated.

Affiliate Link Disclosure: You may assume all links in this article are affiliate links. If you purchase any product or service through the link, I may be compensated at no extra cost to you.

Leave a Reply