Photo by Markus Spiske on Unsplash

With $1.84B in assets under management in just two years, SPYI, the Neos S&P 500(R) High Income ETF, has quickly grown in popularity as one of the premier S&P 500 covered call funds, and for good reason.

In the two years since its inception, SPYI has beaten competitors like JEPI and XYLD with superior distribution yields of approximately 12% compared to the 7% and 9% you’re currently getting from JEPI and XYLD.

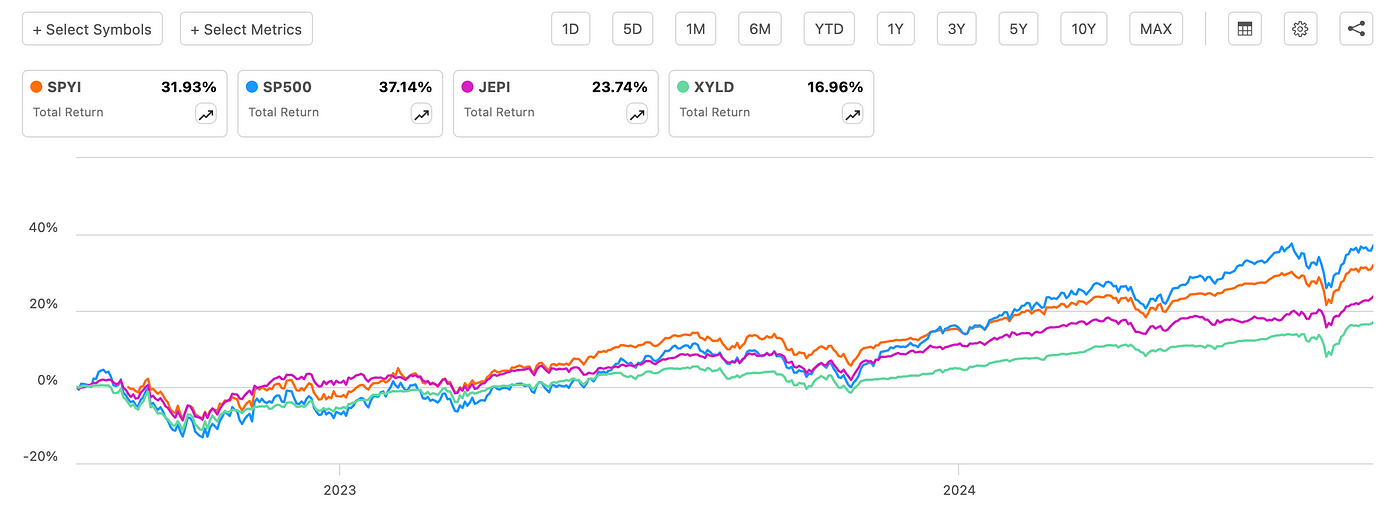

Image From Seeking Alpha | SPYI Vs. S&P 500, JEPI, and XYLD Total Return Since August 2022

Image From Seeking Alpha | SPYI Vs. S&P 500, JEPI, and XYLD Total Return Since August 2022

Today, we’ll examine why SPYI has beaten funds like JEPI and XYLD and whether this performance can be maintained over the long term.

The Power of a Flexible Options Strategy

I wanted to write this article mainly because I learned new information about SPYI that has completely changed my opinion about the fund.

When I first covered this fund in December last year, I thought it was too good to be true.

SPYI: Is This 12.11% Yielding Fund Better Than JEPI?

My basis was that retaining capital appreciation while distributing income was unlikely with my old understanding of the fund.

Previously, I believed that SPYI’s options strategy was static. They sold out-of-the-money SPX call options while buying long call options to protect themselves from sudden stock market gains.

The numbers made no sense with this strategy. How could SPYI maintain a 12% yield when other funds like XYLD yield less despite selling at-the-money covered calls?

Well, an interview with Troy Cates, one of NEOS’ Managing Partners, has revealed information that has corrected some of my misconceptions about the NEOS covered call funds.

Cates revealed that SPYI is not always in a credit spread where it sells both a call option and buys a long call option further out of the money.

I have confirmed this by looking at their current holdings, which do not include any bought call options.

Image From NEOS | Portion of SPYI Holdings September 3, 2024

Image From NEOS | Portion of SPYI Holdings September 3, 2024

Their call writing strategy also isn’t set in stone. It has its moneyness and the portion of the portfolio they write calls on adjusted based on a rules system they developed in response to various market conditions.

For example, if volatility is high, the fund managers may opt to sell their calls further out-of-the-money and on less of the portfolio.

This flexibility is why SPYI has outperformed funds like XYLD and JEPI in a rising market.

When the market changes, SPYI will change with it while the other two funds continue operating as usual. The fund focuses more on generating enough option premiums to achieve its 12% target distribution rate and leaving the rest for capital appreciation.

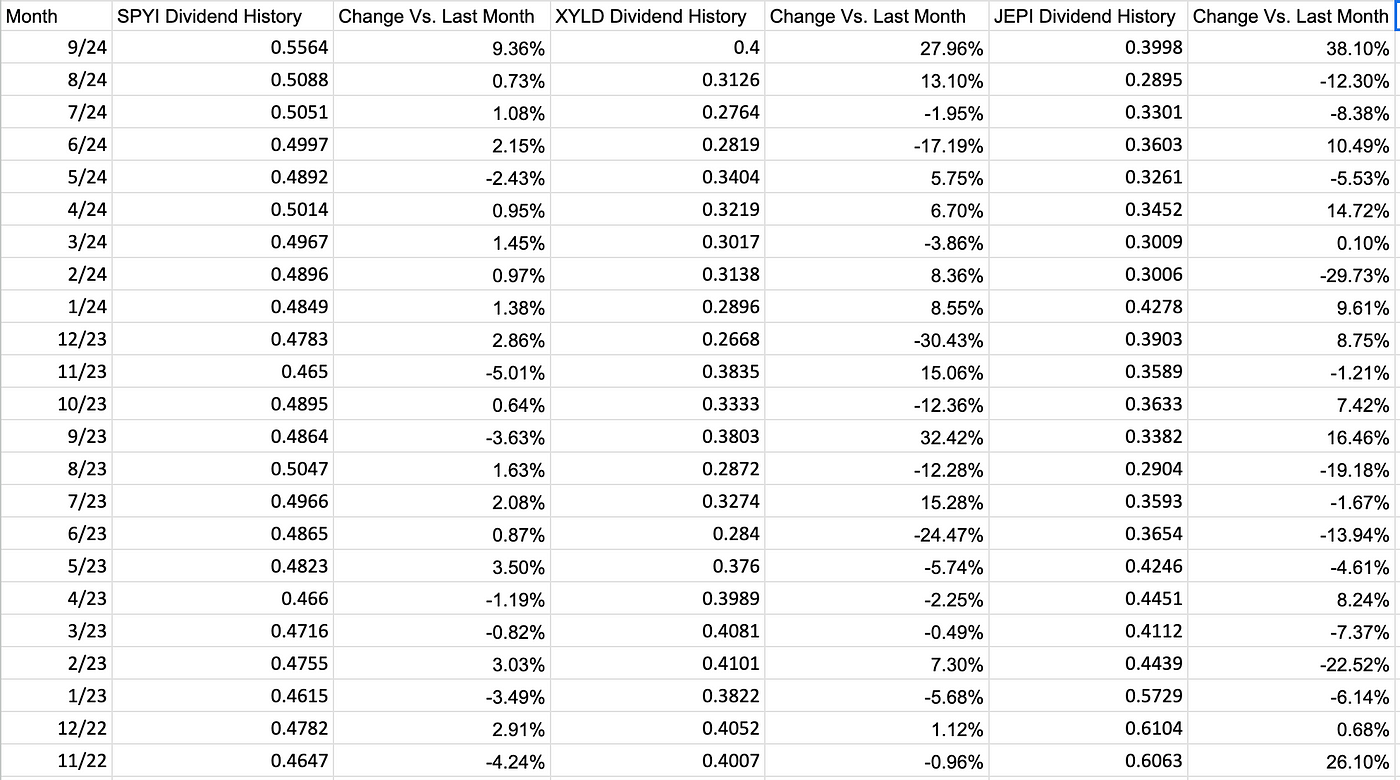

You can see this by studying SPYI’s dividend historical dividend payments compared to other funds.

SPYI’s distributions have only changed by as much as 9.36% in one month, while XYLD and JEPI’s payments fluctuated by 32.42% and 38.10% in the same period.

Image From Author | SPYI Vs. XYLD and JEPI Distribution History and Change Compared To Previous Month

Image From Author | SPYI Vs. XYLD and JEPI Distribution History and Change Compared To Previous Month

A Flexible Options Strategy Doesn’t Guarantee Better Results

Now, I don’t want people to get the idea that having a more flexible options strategy will guarantee better performance.

All a flexible options strategy does is allow for adjustments to potentially enhance total returns. Whether those adjustments are successful is totally up to the fund managers.

So far, the NEOS team has done well. They’ve allowed SPYI to do exceptionally well during a rising market compared to other covered call funds.

But we haven’t seen how SPYI performs during a prolonged down market, though we do have a little bit of data.

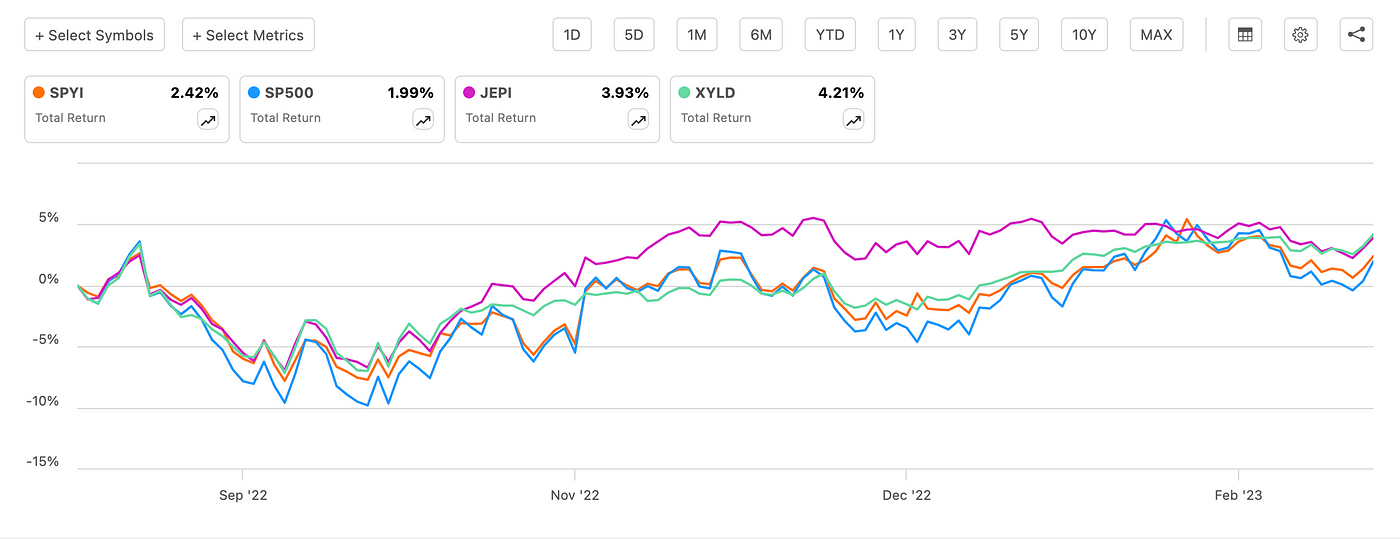

Between September 2022 and March 2023, when the S&P 500 was mostly flat or down, JEPI and XYLD actually outperformed SPYI.

Image From Seeking Alpha | SPYI Vs. S&P 500, JEPI, and XYLD Total Return Between September 2022 and March 2023

Image From Seeking Alpha | SPYI Vs. S&P 500, JEPI, and XYLD Total Return Between September 2022 and March 2023

The reasoning for each fund differs.

JEPI outperformed because its underlying holdings are more defensive in nature, with a significantly smaller concentration in tech than the other two funds.

This makes JEPI a fund that will almost always underperform in bull markets but outperform in bear markets. Their goal is to distribute income with low volatility, so expect to see the fund follow the S&P 500 but with significantly smaller drawdowns and gains.

XYLD shines in a down market because volatility is high, and their ~100% at-the-money covered calls are generating significant option premiums while not getting assigned.

SPYI, however, is focused on reaching their target distributions.

In the interview linked above, Cate mentions how they sell covered calls further out of the money and on a smaller portion of the portfolio during more volatile markets because it has become easier to reach the ~1% per month distribution target.

The idea that they’re not focused on maximizing option premiums, coupled with the fact that SPYI’s underlying holdings are going down in value at the same rate as the S&P 500 during down markets, is why they’ll likely underperform investments like XYLD and JEPI during bear markets.

Why I Prefer SPYI as a Buy and Hold Over JEPI and XYLD

Overall, this new information and seeing SPYI’s performance for almost two years now makes me prefer SPYI as a buy-and-hold income investment over JEPI and XYLD.

That, however, does not necessarily hold true for you.

I like SPYI because I’m comfortable riding down markets. I’m less concerned with an asset’s short-term performance than its long-term performance.

When using covered calls for long-term income, your biggest fear should actually be rising markets and the risk of being assigned. Getting assigned multiple times over is why covered call funds risk capital erosion and losing principal in return for distributions.

So far, SPYI has done well on that end thanks to the fund’s rule-based adjustments.

Image From Seeking Alpha | SPYI Vs. S&P 500, JEPI, and XYLD Price Return Since September 2022

Image From Seeking Alpha | SPYI Vs. S&P 500, JEPI, and XYLD Price Return Since September 2022

But I understand that there are those out there who are more focused on maintaining a lower volatility portfolio. In that case, JEPI would make more sense than SPYI.

There are also people who would do better with the predictability of XYLD rather than putting their faith in SPYI’s fund managers.

For example, it could make sense to add XYLD during certain times and sell during other times when managing a portfolio more actively. However, at that point, consider writing the options yourself.

As always, don’t just blindly follow and listen to whatever I’m saying. It’s highly recommended you do your own due diligence and decide what’s best for your situation.

Want more investment coverage and analysis? Check out the list below for my complete collection of articles analyzing various stocks and ETFs!

Stock and ETF Analysis

Financial Disclaimer: The views in this article are the author’s personal views. This commentary is provided for general informational purposes only. It does not constitute financial, investment, tax, legal, or accounting advice, nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this article should consult with their advisor. The information provided in this article has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Their values change frequently, and past performance may not be repeated.

Affiliate Link Disclosure: You may assume all links in this article are affiliate links. If you purchase any product or service through the link, I may be compensated at no extra cost to you.

Visit us at DataDrivenInvestor.com

Subscribe to DDIntel here.

Join our creator ecosystem here.

DDI Official Telegram Channel: https://t.me/+tafUp6ecEys4YjQ1

Follow us on LinkedIn, Twitter, YouTube, and Facebook.

Originally published on Medium.com. Get a Medium membership and read articles like this one ad-free.

Leave a Reply