-

The Reason Why I Rate JEPI A Sell Even Though It Has Done Its Job

JEPI is likely to outperform the overall market in the next few months, but here’s what you really need to consider.

Readers who follow me on Seeking Alpha may have noticed an interesting trend from me where I have become increasingly aggressive with my ratings. Of the last six ETFs I covered, I rated four a Sell or Strong Sell. These four funds weren’t necessarily garbage funds unsuitable to invest in. Some have done a very good job…

-

Why I Sold 55.55% Yielding YMAX And 17.65% Yielding SVOL

The investing mindset that helps me control emotions and avoid costly mistakes.

Two articles I had recently written on Seeking Alpha were “YMAX: Paying Extra Management Fees For No Good Reason” and “SVOL: Low-Quality Holdings Increase Downside Potential Significantly.” I had given both funds, the YieldMax Universe Fund of Option Income ETFs (YMAX) and Simplify Volatility Premium ETF (SVOL), sell ratings. Like any Seeking Alpha article with…

-

The Times When The S&P 500 Is Not The Best Investment

Why I’m a huge fan of value and dividend investing.

Almost everyone, including myself, recommends investing in a low-cost S&P 500 index fund over the long run. However, the long run is the keyword, and we’re not talking about five or even ten years. No, we’re looking much further at 20, 30, or even 40 years. I want you to take a look at the…

-

This ETF Yields 25.79% And Is Beating The NASDAQ 100 (Get Paid Weekly)

Is Roundhill’s Innovation-100 0DTE Covered Call Strategy ETF — QDTE — a buy?

One of my most viewed articles published in the last few days on Seeking Alpha was one about the Roundhill Innovation-100 0DTE Covered Call Strategy ETF (QDTE) for a pretty good reason. Since its inception in March, QDTE has beaten its underlying index—the NASDAQ 100—in total returns while offering 20%+ yielding weekly distributions. Image From Seeking Alpha | QDTE…

-

Top 5 High Yield S&P 500 Buy-Write ETFs (7–18% Yields)

My favorite S&P 500 covered call funds worth considering in your income portfolio.

Covered call funds have become extremely popular this decade, with numerous companies launching high-yield, monthly (and sometimes even weekly) paying ETFs. One of the most popular strategies companies have adopted is selling covered calls on indices like the S&P 500 and NASDAQ 100, but every company has its own twists. Each time a new fund…

-

XDTE Has Beaten The S&P 500 While Paying Weekly 18%+ Dividends

Why NAV decay is only part of the story and what you should also be looking at.

In this decade, options funds have become extremely popular. It started with covered calls on index ETFs like the S&P 500. Then we got covered calls on individual stocks and all sorts of assets, including Bitcoin, bonds, and other commodities. This doesn’t include all the innovations in the strategies we have been using with covered…

-

How To Publish Your First Article On Seeking Alpha (and Earn $45+)

Tips and tricks to help you make money writing on Seeking Alpha.

A few months ago, in July, I published my first article on Seeking Alpha. It was a tough run. I had spent hours researching Yonex stock and thought I had written my most in-depth article ever, only to spend another week revising and resubmitting it. It took me nearly two weeks to get one article out,…

-

This Site Pays $45+ Per Article With No Viewers For Your Articles On Investing

How to make more money writing about stock investing.

Friday, September 6th, 2024. 11:25 AM. I had been editing a badminton video since 9 AM and decided to take a small break to check my phone. That’s when I saw a Gmail notification, “Article Status Notification from Seeking Alpha Editors.” A sudden wave of excitement and nervousness rushed over me. I had written and…

-

Why SPYI Beat JEPI And XYLD In Rising Markets

The power of having a flexible options strategy.

Photo by Markus Spiske on Unsplash With $1.84B in assets under management in just two years, SPYI, the Neos S&P 500(R) High Income ETF, has quickly grown in popularity as one of the premier S&P 500 covered call funds, and for good reason. In the two years since its inception, SPYI has beaten competitors like JEPI and XYLD with…

-

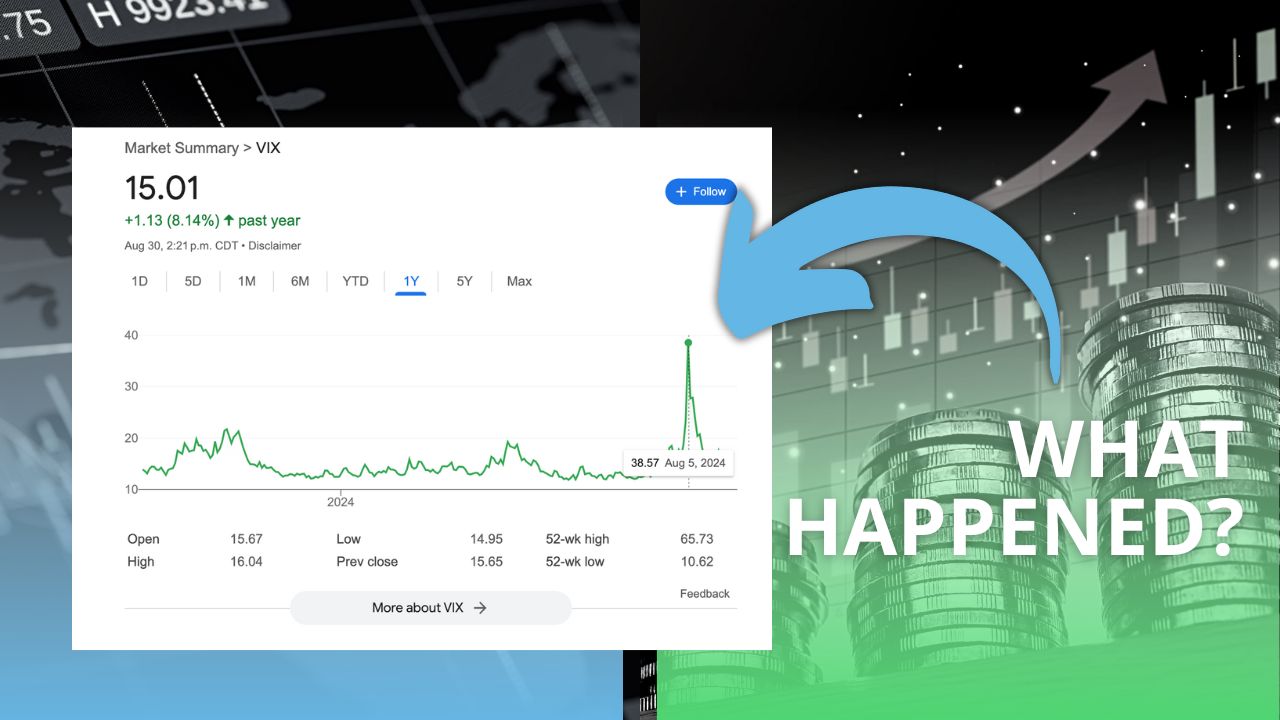

SVOL Has Survived Its Biggest Test So Far (Sustainable 15%+ Yield)

SVOL has become an ETF worth adding to your income portfolio.

About a year ago, I wrote two articles about SVOL, the Simplify Volatility Premium ETF. SVOL Currently Yields 17.68%; Is This Dividend Sustainable? SVOL’s Strategy Has Changed. Can It Maintain Its 16.53% Yield? As you can see from the two article titles, SVOL pays a sizeable monthly distribution and has consistently yielded above 15% yearly,…